When we open a new bank account our bank gives us a lot of details which include the IFSC code, Branch Code, Customer ID, etc. Along with these details, we also get a bank account number. But what is this number all about?

A bank account number is a unique number that is assigned to every account by the bank. This number is different for all the bank accounts throughout India. Two different bank accounts can never have the same account numbers.

Why Banks Provide this Number?

The banks will be having thousands of customers so they have to make a differentiation between all the customers. At the same time, this is the primary number that lets you deposit money in your account.

For example, Now let us assume that you have visited the branch of your bank and want to deposit some money into your account. There you will get a deposit slip on which you will have to enter your account number along with your name.

Just like this if your employer wants to send you salary or any other person wants to send you money. Then you will have to provide your account number along with the IFSC code to that person. This is why this number is very important and the banks provide this to the customers.

You should also keep in mind that this number should not be shared or made public until the need arises.

Can I Choose My Account Number?

Yes, you can choose your account number. Currently, this feature is being offered by multiple private banks that are running their operations in India

Which Banks allow to Choose the Account Number?

I did my research and found out the Indian Banks that allow the customers to choose the account number. All those banks are listed down below.

- ICICI Bank

- IndusInd Bank

- HDFC Bank

- Yes Bank

- DCB Bank

- RBL Bank

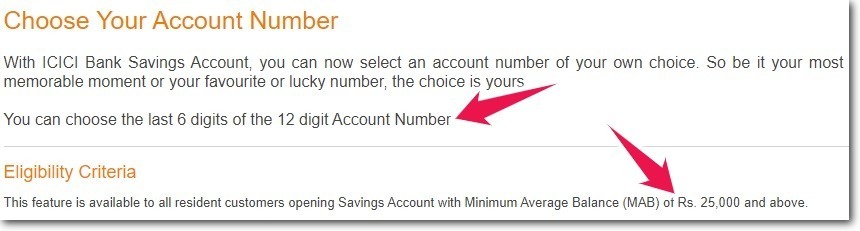

ICICI Bank: ICICI Bank allows the customers to select 6 digits out of 12 digits while opening the account. This feature is available for customers who are ready to maintain a monthly average balance of Rs. 25,000 and above.

For more details visit here: Choose Your Account Number – ICICI Bank

IndusInd Bank: IndusInd Bank allows you to choose your account number to your date of birth or your mobile number. If you choose the mobile number option then your mobile number will become the last 10 digits of your bank account number.

For more details visit here: My Account – IndusInd Bank

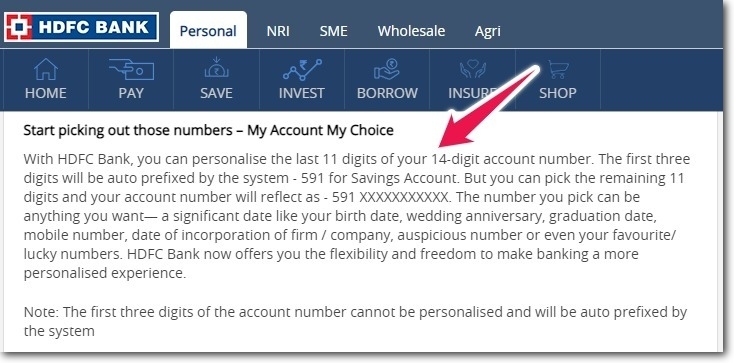

HDFC Bank: HDFC Bank allows the customers to choose the last 11 digits of the account number. The first 3 digits will be set by the system as per the different codes for different account types.

For more details visit here: How to Personalize Bank Account Number – HDFC Bank

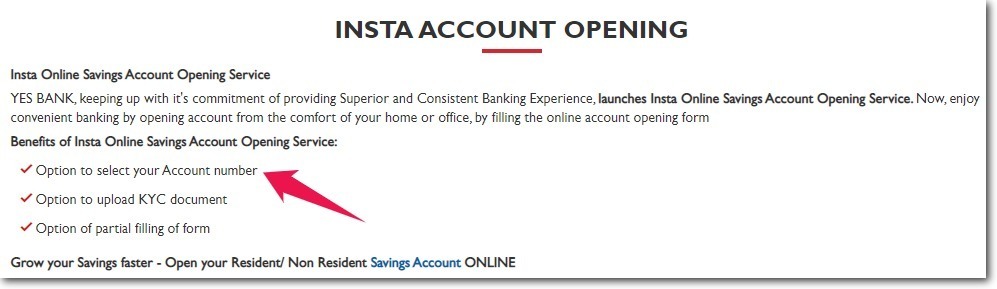

Yes Bank: If you are planning to open a new bank account with Yes Bank online. (Insta Account Opening) Then you will be getting the freedom to choose your account number.

For more details visit here: Insta Account Opening – Yes Bank

DCB Bank: If you open DCB Elite Savings Account then you can select the last 8 digits of your bank account number. The remaining numbers will be assigned by the bank.

For more details visit here: DCB Elite Savings Account – DCB Bank

RBL Bank: RBL Bank allows the customers to choose their account number when they choose Aspire Banking services.

For more details visit here: Aspire Banking – RBL Bank

Can I Change My Account Number?

No, you can not change the account number of an existing account. But you can open a new account and select the number of your choice.

Even if you approach your bank and ask them to change the number for you. They can not do it.

But there are two options for you.

The first one is to open a new bank account with the number of your choice.

And the second opinion is to close the existing account and open a new one with the same or different bank which gives you the freedom to choose the account number.

How to Find My Bank Account Number?

If you don’t know your account number then there are a number of methods to find it out.

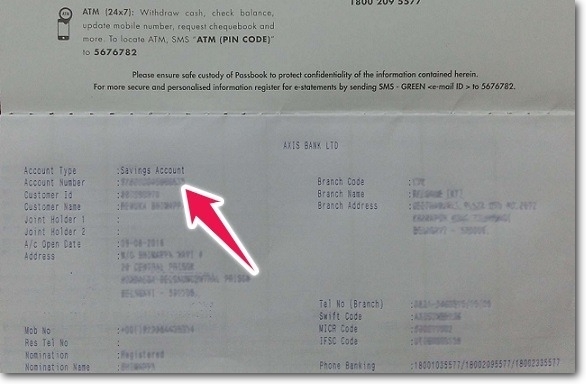

Using the Bank Passbook

A bank passbook is the most basic documentation that we receive from the bank after opening the account. All you have to do is take your passbook and open the first page of the bank. Your account number will be mentioned on the first page of the bank.

Using Welcome Letter

The banks send the customers a welcome letter when a new account is opened. The objective of this letter is to provide the details of the account which has been opened. This letter consists of details like the type of account, name of the customer, address of the customer, customer ID, and account number. So you can refer to the welcome letter and find your number easily.

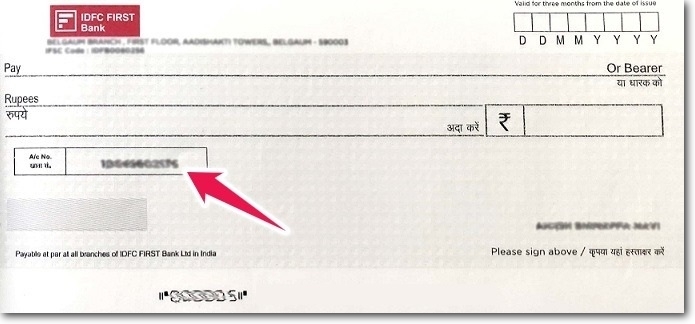

Using Cheque Book

If you have received a cheque book from your bank then take your cheque book and open it, the bank account number will be mentioned on every cheque leaf.

Visiting the Branch of the Bank

You can visit the branch of the bank where you have opened the account and take help the bank employees to find your account number. But while visiting make sure that you carry any one identity proof document with you. You should carry the original copy or else show the document in the Digilocker App.

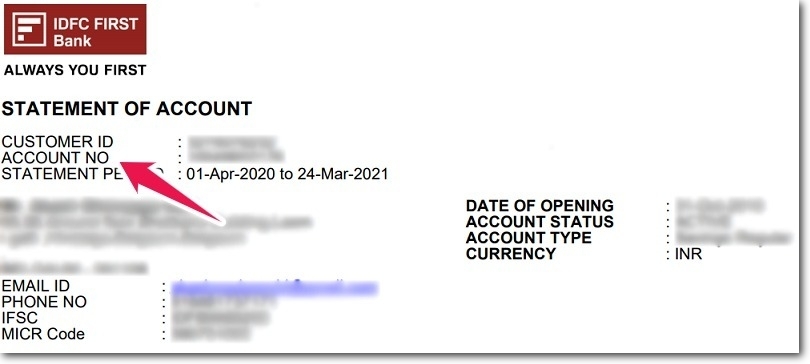

Using the Bank Account Statement

You can download and open the account statement for any month. Your account number will be mentioned in the upper part of the statement.

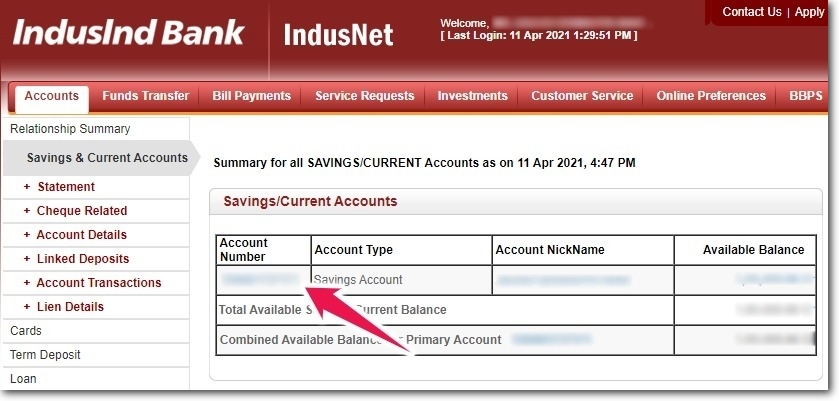

Using Internet Banking

To find your account number go to the official website of your bank and login into your internet banking account. As soon as you login into your account the account number will be displayed in the dashboard.

Using Mobile Banking App

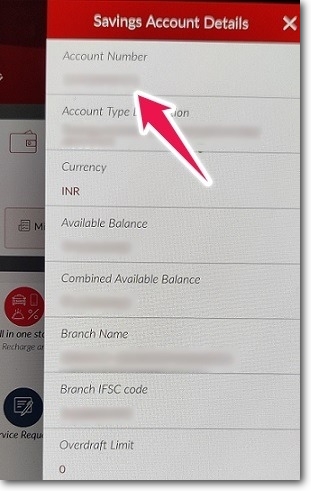

Open the official mobile banking app of your bank on your smartphone. If you don’t have it installed then get it installed from Google Play Store or Apple App Store. Enter your account details into the app and login into the app. Go to the Account details section of the bank app and you will be able to find your account number there.

Number of Digits in Account Number of Different Banks in India

I have created a table below which tells you about the number of digits in the account number of all the banks in India.

| Name of the Bank | Number of Digits in Account Number |

| AU Small Finance Bank | 16 |

| Axis Bank | 15 |

| Bank of Baroda | 14 |

| Bank of India | 15 |

| Bank of Maharashtra | 11 |

| Canara Bank | 13 |

| Catholic Syrian Bank | 18 |

| Central Bank of India | 10 |

| Citi Bank | 10 |

| DCB Bank | 14 |

| Dhanlaxmi Bank | 16 |

| Equitas Small Finance Bank | 12 |

| Federal Bank | 14 |

| HDFC Bank | 13 or 14 |

| HSBC Bank | 12 |

| ICICI Bank | 12 |

| IDBI Bank | 13 or 14 or 15 or 16 |

| Indian Bank | 9 |

| Indian Overseas Bank | 15 |

| IndusInd Bank | 12 |

| Jammu and Kashmir Bank | 16 |

| Karnataka Bank | 16 |

| Kotak Mahindra Bank | 14 |

| Punjab and Sind Bank | 14 |

| Punjab National Bank | 16 |

| RBL Bank | 12 |

| South Indian Bank | 16 |

| Standard Chartered Bank | 11 |

| State Bank of India | 11 |

| Tamilnad Mercantile Bank | 6 to 15 |

| UCO Bank | 14 |

| Union Bank of India | 15 |

| Yes Bank | 15 |