If you want to pay someone a sum of money then we here in India have too many options. And one among them is the demand draft. This is also commonly known as DD. In this article, we will learn everything you need to know about this instrument used for money transfers.

What is a Demand Draft?

Demand Draft or DD is a negotiable instrument that is used to pay or transfer money from one person to another. This is issued by a bank as a direction to another bank or a branch of its own to pay a sum of money to the payee. The banks charge a small amount of fee to issue a demand draft.

This instrument is usually compared to the cheque mode of payment. But there are a lot of differences between the who which we will learn in the latter part of this article. But it is an open secret that anyone would prefer to receive a DD than a cheque for the payment. This is because DD’s are hard to counterfeit in comparison to cheques.

Here there are two parties involved other than the banks and they are,

- Drawer

- And the Payee.

Who is a Drawer?

A drawer is a person who is paying for the bill of exchange or the demand draft or the cheque. 1

In simple words, a drawer is a person who is paying the bank for the money transfer instrument. And directing the bank to pay a sum of money to another person.

For example, let us assume that Mr. Akansh is paying Mr. Sunil a sum of Rs. 50,000. Then Mr. Akansh is the drawer of the DD here.

Who is a Payee?

A payee is a person in favor of whom the demand draft is prepared. 1

Basically, here is the payee is the person who is going to receive the money from the bank when he or she presents the DD in the bank.

For example, let us assume that Ms. Ankita is paying her college a sum of Rs. 60,000 as her semester fees. Then here the college which is receiving the fees is the payee of the DD.

What is a Negotiable Instrument?

A negotiable instrument is the one in which the payee is guaranteed to be paid the sum of money. There is no matter of contingency here. 2

If you are getting a negotiable instrument from someone in your name, then it is 100% sure that you will be paid by the bank.

Why Demand Draft is Considered as a Negotiable Instrument?

Demand Draft is considered a Negotiable instrument because the drawer has to pay the bank before he or she gets the demand draft in the hand.

Until and unless the complete payment is done by the drawer to the issuing bank, he or she will not get the DD.

So as the drawer has already paid the issuing bank, this guarantees that the payee will receive the money from the bank.

The basic concept is the person can get a DD only when he or she has the complete amount of money.

For example, Mr. Amit wants to get a DD of Rs. 20,000 in the name of Mr. Sumit. Here Mr. Amit will not get the DD from the bank until he pays a complete sum of Rs. 20,000 to the issuing bank.

As the money is already paid by Mr. Amit to the bank, it is guaranteed that Mr. Sumit will get paid when he presents the DD to the bank in a given period of time.

Why Cheque is Not Considered as a Negotiable Instrument?

A cheque is not a negotiable instrument because anybody with a cheque book can issue a cheque of any amount. Even if they don’t have sufficient balance in their bank account.

In this case, a person might receive a cheque in hand, but that does not guarantee that the cheque will be encashed when presented to the bank for clearing.

For example, Mr. Raju is issuing a cheque to Mr. Subash of Rs. 10,00,000. But Mr. Raju does not have a sufficient balance in his bank account.

Mr. Subhas goes to the bank and deposits the cheque for clearance. But as there is no sufficient balance in Mr. Raju’s bank account, the cheque will bounce.

Features of Demand Draft

There are various features of a demand draft that you should know. I have explained the major ones below.

Being Bank’s Customer is Not Mandatory

This means even if you don’t have an account with a bank you can get a demand draft from it.

All you have to do is walk into the branch of the bank, complete the formalities, pay the money and get the demand draft from the bank.

For example, Mr. Animesh does not have a bank account with HDFC Bank, but he wants to get a DD from the bank. He can still get it by visiting any branch of HDFC Bank and completing the formalities required.

It is a Prepaid Instrument

Demand draft is a prepaid instrument which is the biggest reason that makes it a negotiable instrument of money. When a person steps into any bank he or she has to pay the money to the bank. And then the DD will be issued.

For example, If Ms. Pooja wants a DD of Rs. 1,00,000 from the State Bank of India. She has to pay the money upfront to get the DD from the bank

Demand Draft Can not be Paid to the Bearer

If a bearer is carrying the DD to the bank, then the bank will not pay him the money in any situation.

Here it is important for us to understand the meaning of the term “Bearer”.

A person or thing that carries, upholds or brings. 3

For example, Mr. Anirudh has received a DD worth Rs. 5,00,000. And he has sent his employee as the bearer to the bank to bring the money.

But the bank will not pay the money to the bearer. The money will be paid to only the person in whose name the DD has been issued.

Demand Draft is Not Transferable

The DD is not transferable from one person to another person in any situation. If you want to change the person’s name in which the DD has been issued.

Then you will have to cancel the current DD and get a new one in the new name. But the bank will not change the name of the person on the DD which has already been issued.

For example, A DD has been issued in the name of Mr. Sumit, but now he wants to change the name to Mr. Abhishek. This can not be done in any situation.

DD is Payable at Branch of Same Bank or Other Bank too

The demand draft is paid to the payee at the branch of the bank that has issued the draft and also at the branch of any other bank.

For example, A demand draft has been issued by ICICI Bank, but the payee can get the money by presenting it to any branch of IDFC FIRST Bank too.

A DD Can be Cancelled

You can cancel the DD and get the money back from the bank, but there is a procedure to follow. And here you have to keep in mind that, the DD can be canceled only before it is withdrawn.

But in case the payee has already presented the DD and has taken the money out of it. Then there is no sense in approaching the bank and asking it to cancel your DD.

Every bank in India has a very strict process to cancel a DD and a small amount of cancellation fee is taken from the Drawer for this service.

Demand Draft can Not be Stopped, Until the Court Orders

A demand draft can not be stopped once issued in normal circumstances. But if the court orders then the payment will be stopped. 4

For example, there is a deal between two people for Rs. 10,00,00 whose payment is being done using a DD. Once the payee party receives the DD in hand, the payment can not be stopped by any means. But if there is a court order then the payment will be stopped by the bank.

Both the Parties are Banks

In the case of a Demand Draft both the parties that are involved in the transaction are considered to be the banks. The one which is issuing the draft and the other which is paying the money to the payee. 5

A Duplicate DD can be Issued

If the issued DD is lost somewhere then the drawer can ask the bank to issue a duplicate demand draft. But again there is a strict procedure that has to be followed.

And here the drawer has to show the proof to the bank that the DD was issued to him or her. There will be a form that has to be filled, signed, and submitted by the drawer to the issuing bank.

Demand Draft Comes with an Expiring Date

DD’s come with an expiring date just like the cheques. After this date is passed a DD can not be used to get the money from the bank.

When does a Demand Draft expire?

A demand draft expires after 3 months from the date it has been issued. 6

Where Demand Draft is Used the Most? (Uses of DD)

The major uses of Demand Draft are explained below.

Demand Draft for RTI

If you want to use the RTI act to get some information. Then you may have to use the demand draft for the payments of the fees.

In the case of the RTI that falls under the Central Government of India. The fees have to be paid online.

But in the case of an RTI filing that falls under the state government. You will have to find out the details of the public information officer.

Once you have the address and the details of the Public Information Officer. You can draw a DD in favor of the concerned authority. (in case of some states) 7

Demand Draft for College Fees

There are many colleges that take the fees in the mode of demand draft. So if the college is asking for the fees to be paid in this mode.

Then you will have to draw the DD as per the information given by the college.

Demand Draft in Favor of RTO for Fancy Number

If you want to get a fancy number for your vehicle. Then a large number of RTO’s in India accept the payment via a Demand Draft.

The officers working for RTO will guide you with all the details that you will need for this purpose. The details like the name which should be mentioned on the DD, etc. will be given to you.

Mostly during the fancy number auctions, this instrument is used. Where you have to enter the details of the DD in an online portal. And then visit the office with the physical copy of the DD.

Please note that this process is for authorized users only. And you should not do anything until you are told to by the RTO to avoid losses. 8

Demand Draft for Payment of Road Tax

There are some states in India that require people of other states to pay road tax if they want to enter into the state.

For example, Karnataka, if you want to enter Karnataka with your vehicle then you will have to pay the tax to avoid penalties.

Note that this may not be applicable for everyone and every type of vehicle. The total process involved can take 10 to 15 days to complete. 9

Demand Draft for Property Registration

The stamp duties, registration charges for registering a property need to be paid using a demand draft in certain states of India.

These charges and the exact procedure may change from state to state. But in the case of some states, the registration authorities accept payment via a DD. 10

Types of Demand Draft in India

There are two types of demand drafts in India. 2

1. Sight Demand Draft

This type of demand draft is paid immediately to the payee. But in the case of the Sight DD, the money will be paid only after verification of certain documents. If the payee fails to provide the said documents then the bank will not pay the payee.

2. Time Demand Draft

This type of demand draft will be paid by the bank only after a specific period of time. At the same time, it also has an expiry date after which it will not be paid by the bank.

How does Demand Draft work?

The first thing is the person who wants a DD selects a bank of his or her choice. The drawer then goes to the bank and speaks with the bank officials.

Tells the bank officials that there is a need for a DD and explains the purpose.

The bank officials will then explain the ways by which the drawer can apply for a demand draft. If the drawer has an account with the issuing bank. Then the internet banking can also be used to request a DD.

But in case, the drawer does not has an account with the issuing bank still a DD can be obtained.

The bank officials will provide a demand draft request form which should be filled by the drawee.

Generally, this form includes details like the name of the drawer, payee, amount, mode of payment, etc.

The drawer then fills the form and submits the form to the bank officials. Bank officials will check the form and take the money from the drawer.

Once the payment is done successfully by the drawer. The physical copy of the demand draft is given to the drawer.

Now the drawer has to hand over the DD to the person in whose favor the DD has been issued. This is the last step in which there is an involvement of the drawer.

Here the work of the payee starts. The payee can go to the branch of the bank which has issued the DD. Or any bank of his or her choice.

Present the DD for clearance, and in case it is a Sight DD then required documents have to be presented. The bank will verify everything and makes the payment to the payee as the amount mentioned on the DD.

How to Get a Demand Draft?

There are two ways in which you can get a demand draft from the bank for your choice. And they are online and offline.

Getting a Demand Draft Offline from Branch

Visit the branch of the bank from which you need a demand draft, ask for a demand draft application form. Fill the form with all the required details.

Once you have filled in all the details, check it, if you find all the details correct then sign the form.

Submit the form to the draft issue counter, and make the payment for the DD.

You can pay for the DD by cash or cheque. And if you hold an account with the same bank then you can ask the bank to directly charge you from your account balance.

How to Fill the Demand Draft Application Form?

There are two parts to the demand draft application form. The first part of the customer copy which you can keep with you. And the second part is the bank’s copy which the bank will keep for the purpose of reference.

You can refer to the video below to learn how you can fill the form.

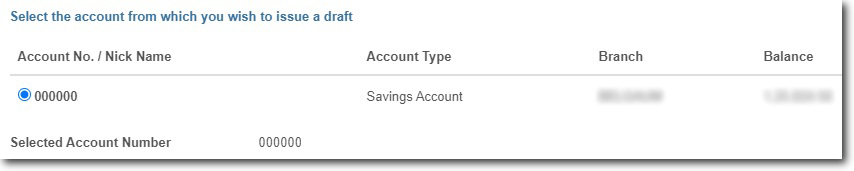

Getting a Demand Draft Online using Internet Banking

If you want the DD from the bank with which you hold an account. Then you can apply for the DD online using internet banking.

To get the DD to visit the official website of your bank and login into your internet banking account.

Go to the “Request and Enquiries” section of the internet banking and click on “Issue Demand Draft”.

Select the bank account number from which the bank should deduct the money.

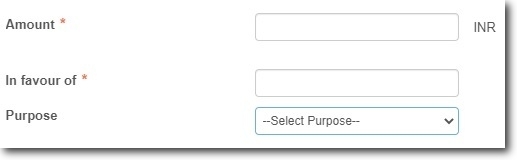

Enter the amount and the details of the payee in whose favor you want the DD to be issued. And select the purpose from the drop-down menu. Selecting the purpose of the issue is not mandatory.

Select the branch of the bank from which you want to the DD. Here you have to enter the branch code. In case you don’t know the branch code then you can use the branch locator tool of the bank.

However, by default, your home branch will be selected. In the same way, you also have to select the branch where the DD is payable.

Now you have to select the mode of delivery. There are two options the first one is you can collect the DD from the issuing branch. And the second option is the bank can send you the DD by courier to your registered address.

Choose the mode of delivery and click on the “Submit” button.

Things to Keep in Mind:

- Please don’t select administrative offices like RBOs, ZOs, LHOs, SBLCs, RACPCs, etc. as the paying branch at which the demand draft is to be payable.

- You can issue a Demand Draft from any of your Accounts (Savings Bank, Current Account, Cash Credit & OverDraft).

- If the Mode of Delivery is Collect in Person, you can collect the draft from the debit branch.

- If the mode of delivery is courier, the Demand Draft will be mailed to your registered address. For this separate courier charges will be deducted from your account.

- Select the “Collect in Person” option only if you can visit your home branch during their working hours.

How to Cancel a Demand Draft?

If you want to cancel the demand draft for some reason then you have an option to do it. The bank will cancel your demand draft and money will be credited into your bank account.

But here you should know that the bank will charge you for the cancellation and it is not done for free.

So to cancel the DD you should have the original copy of the same. And also should be ready to pay the DD cancellation charges.

To cancel the demand draft you have to write an application letter to the branch manager of the bank which issued you the demand draft.

The subject of the letter should be “Cancellation of the Demand Draft”.

Once the application letter is ready go to the issuing branch and submit it along with the original copy of the DD. The bank will look into this matter and your DD will be canceled and the money will be credited back into your account. 11

You can refer to the video above for more information about the cancellation of the Demand Draft.

Footnotes

1. Drawer, Drawee, and Payee Meaning in Bill of Exchange Simplified – PSKPedia, Accessed: 22/04/2021

2. Negotiable Instrument – Overview, Features, and Types – Corporate Finance Institute, Accessed: 22/04/2021

3. Bearer | Definition of Bearer – Dictonary.com, Accessed: 24/04/2021

4. Indian Money, Accessed: 24/04/2021

5. 10 Interesting Facts about DD – Good Returns, Accessed: 24/04/2021

6. Revised Validity Period of Cheques, Drafts & Banker’s Cheques – Standard Chartered India, Accessed: 24/04/2021

7. All about RTI, Procedure, and RTI application format – Pharmagang, Accessed: 24/04/2021

8. Fancy Number Online Auction and Booking – Parivahan, Accessed: 24/04/2021

9. How to Pay Road Tax in Karnataka? – Drive Kool, Accessed: 24/04/2021

10. 10 Things to Keep in Mind Before Registering a Property – Vakilsearch, Accessed: 24/04/2021

11. How do You Cancel a Demand Draft at SBI – Quora, Accessed: 04/05/2021