Bank accounts are meant to deposit and withdraw money. Because we all have one or more accounts. And we deposit or store almost all of our money in the accounts.

But that does not mean we will never withdraw money from the bank. There can a number of reasons why we will need physical money.

That is a different thing that we Indians are adopting digital payments. But still, there are many places where digital payments don’t work. Or simply we don’t want to use the digital form of money.

In such cases, we will have to get the money out of our bank account. That is to withdraw it.

But how?

That is what exactly we will be discussing today in this article.

There are many ways by following which you can withdraw money from the bank account. We will discuss all of them and learn everything possibly related to them.

What is the Meaning of Withdrawing Money?

In simple words, withdrawing money from the bank account is nothing but getting the physical money from your bank. The sum of withdrawal can be equal to or less than your account balance.

And in case if you hold an account that has an overdraft facility. Then you withdraw up to the maximum overdraft limit of your account.

For example, let us assume that Mr. Akansh has Rs. 1,00,000 in his bank account. But currently, he can not touch this Rs. 1,00,000.

That is because the money that he has in the account does exist in the real world. But it is intangible in manner. So in order to turn this into a tangible form. He can withdraw money from the bank.

When he does that he will get real physical cash from the bank. This is nothing but withdrawing money from the bank account.

What are the Requirements to Withdraw Money?

There are some requirements that you have to meet in order to withdraw. Let us discuss the major ones one by one.

1. The Bank Account Should be Active

The account from which you want to withdraw money from should be active. If the account is on hold or has been turned inactive by the bank. (dormant)

Then you can not withdraw money from such an account. There is a different process to do it.

How to Withdraw from Inactive or Dormant Account?

If your account has turned dormant that does not mean you can not withdraw the money. After all the money or the balance in the account is your asset.

So you will have to request the bank to reactivate your dormant account. The bank will do it for you. And once your account is activated again you can withdraw money from it.

Here you should understand that every bank has its own protocol to be followed. The banks require the account holder to visit the home branch or the nearest branch.

And submit a written request. Some banks even charge some fees for this kind of reactivation.

2. You Should Have Access to the Account

Everyone is not allowed to access everyone’s account. If I hold an account with any bank. Then that account is completely my property. All the money that is there in my account belongs to me.

Considering this, you should have access to the account from which you are withdrawing the money.

So it should be your individual bank account. Or a joint account which you own and operate with some other parties.

In case it is not your account then you are legally not allowed to withdraw money from such an account.

If it is an account of someone you know i.e. your friends or family. Then you can withdraw money only if you have the consent of the account holder.

The account holder should give the debit card to you along with the PIN number with permission to use it. Or you should receive a cheque or demand draft from the account holder in your name.

In case you are the legal guardian of the child who has an account. (minor account) Then you will have access to the account. 1

And one more special case is. You should be a nominated person of the account which belongs to someone deceased. 2

3. There Should be Sufficient Balance in the Account

The account from which you want to withdraw should have a sufficient balance in it. No matter which instrument you are using.

If you don’t have enough balance in the account or if you have a negative balance in the account. Then your transaction will be declined by the bank.

If you have a savings bank account then there can be no negative balance as per the notification of RBI. 3 But if you have other types of accounts then you might have to deal with it.

For example, let us assume that Ms. Rupa has Rs. 2,00,000 in her savings bank account. And she wants to withdraw Rs. 2,10,000.

This is not at all possible with a Savings bank account. So what happens is the bank will decline the transaction.

In the same way. If you use your debit card and try to withdraw money more than what you have in the account. Then some bank also charges for the declined transactions. 4 So you should be aware of this.

And if you have a current account then you can withdraw your balance + your overdraft limit. But not more than that.

4. You Should Have Proper Instruments

First of all, you should decide by which way you want to withdraw the money. And then you should make sure you have a proper instrument with you.

Let me explain this to you in brief.

If you want to withdraw money from an ATM machine. Then you should have an active debit card that is linked to the bank account.

If you want to withdraw using a cash withdrawal form. Then you should have it with you. This form is available on the official website of your bank and also at the branch.

If you want to withdraw using an ATM Machine without using the debit card. (cardless withdrawal) Then you should have access to the official mobile banking app of your bank. And your registered mobile number.

In the same way. If you want to withdraw using a self cheque. Then you should have your cheque book with you.

This is what I exactly mean by proper instruments for withdrawing money from the bank.

5. Go to the Bank During Working Hours

If you are using the ATM machine to withdraw money from the bank. You can do it any time of the day even during holidays. With respect to the availability of cash in the machine, you want to use.

But this is not the case when you want to withdraw money by visiting the branch of the bank. So you will have to make sure that you visit the bank during working hours.

Different Ways to Withdraw Money From Bank

There are different ways that you can follow to withdraw money from your account. I have explained all of them below.

How to Withdraw Money from ATM Machine?

The easiest way to withdraw money from the bank is with the help of an ATM machine. To follow this method you will need two things.

An active debit card linked to your bank account and your 4 digits PIN number.

Should I Use ATM Machine Owned by My Bank Only?

Many people have this doubt in their mind if they should use the ATM machine of their bank only. If even you have this doubt in your mind.

Then let me answer this.

You can use the ATM machine of any bank in India. It is not mandatory to use the machine of your bank only. But you also need to keep a track of the number of times you have used your card. (in the current month)

Every bank offers free usage of debit cards and these vary from bank to bank. If you want to use the card for making more transactions. Then you can still do it.

But your bank will charge you for each transaction. 5

Are there any Limits on ATM withdrawal per Day?

Yes, there will be a limit set on your daily ATM withdrawals. And you can not withdraw more than that using your debit card.

This limit depends upon the type of debit card you have received from the bank.

If you have a normal card then your daily withdrawal limit will be less. But if you have a premium or any high-end debit card. (Platinum and Gold Cards)

Then your withdrawal limit can be Rs. 50,000 to More than Rs. 1,00,000 per day.

Step 1: Find and Visit any ATM Machine that is Near to You

The first thing you have to do is. Find and visit any ATM machine that is near you to your current location. If you are new to the area. Then you can make use of the map applications. (Google Maps, Apple Maps, etc.)

But I recommend you prefer the ATM machine that is operated by your bank.

What I mean is if you hold your account with the State Bank of India. Then try to find the machine that is being operated by the State Bank of India itself.

Step 2: Insert your Debit Card into the Machine

Insert your debit card into the machine. Here you have to note one thing. If you have a debit card that has an EMV chip on it.

Then you should not remove the card from the machine until your transaction is over. The machine will hold your card during the process.

So don’t try to pull it out. Doing so can cause damage to your card and also the machine. If you don’t want to continue and want to get your card back.

Then press the cancel button and the machine will release your card.

But in case if you don’t have an EMV chip on the card. Then you will have to dip in and dip out the card. The ATM machine will use the magnetic stripe on the backside of the card to read it.

Step 3: Select the Language

ATM machines across India are multilingual which means you can use the machine in multiple Indian languages. Hindi and English are normally available.

Along with these two languages, you can also use the machine in the local language of your state.

So now you have to select the language in which you would like to use the machine.

Step 4: Enter your PIN Number

Once you have selected the language of your choice. The machine will ask you to enter your 4 digits debit card PIN number.

During this time you should not take the help of anyone near you. And you should avoid sharing your debit card details with anyone.

If you share then you are putting your own money in danger.

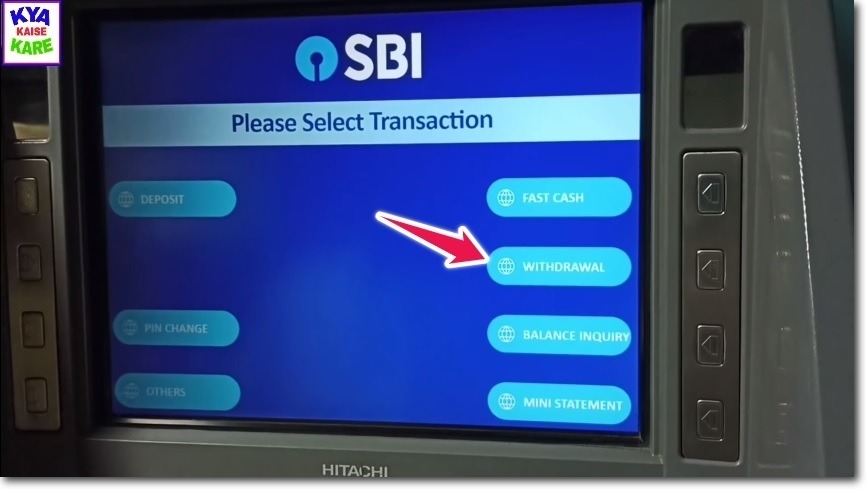

Step 5: Select Withdrawal

These days the ATM Machines are not only used for withdrawing cash but they also offer many other services. But here we just need to use the “Withdrawal” option.

So select the “Withdrawal” option. If the machine has a touchscreen then you can use it. Or else you can use the buttons that are placed at the sides of the screen.

Step 6: Select the type of your Bank Account

Debit cards are not only issued to the customer holding a savings bank account but they are also used by the current account holders.

And people also use the ATM machine to withdraw money from their credit cards as well.

That is the reason why the machine offers multiple options in this step. And they are,

- Savings Bank Account.

- Current Account.

- Credit Card Account.

So select your type of account from the options.

Step 7: Enter the Amount of Money you want to Withdraw

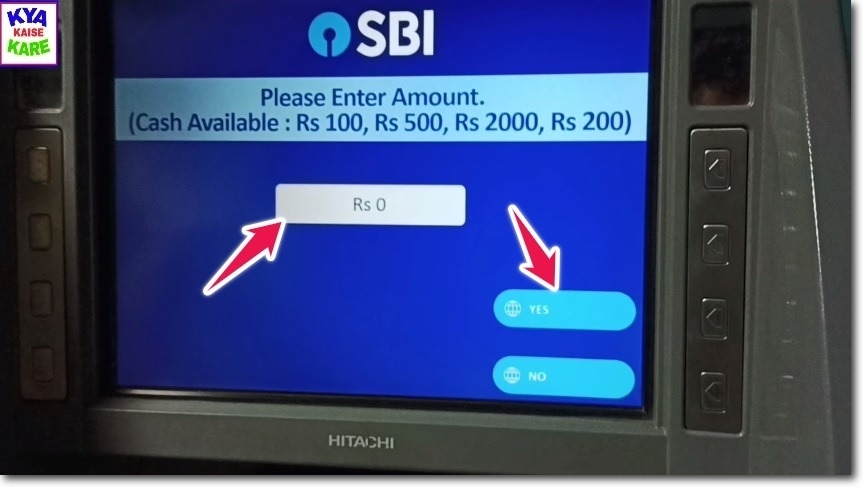

Now you have to enter the amount of money you wish to withdraw from the machine. You have to enter the amount of money in multiples of Rs. 100, Rs. 200, Rs. 500, or Rs. 2,000.

This depends upon the denomination availability in the machine. The machine will show you the available denomination on the screen.

So you can enter the amount according to availability.

Step 8: Choose if You want a Printed Receipt (Some Machines Ask)

Now the machine will ask you if you want a printed receipt about the transaction you are doing. If you need one then select Yes.

And if you don’t need one then select No. I recommend you select No and save the paper. After this selection, the bank will start processing your withdrawal request.

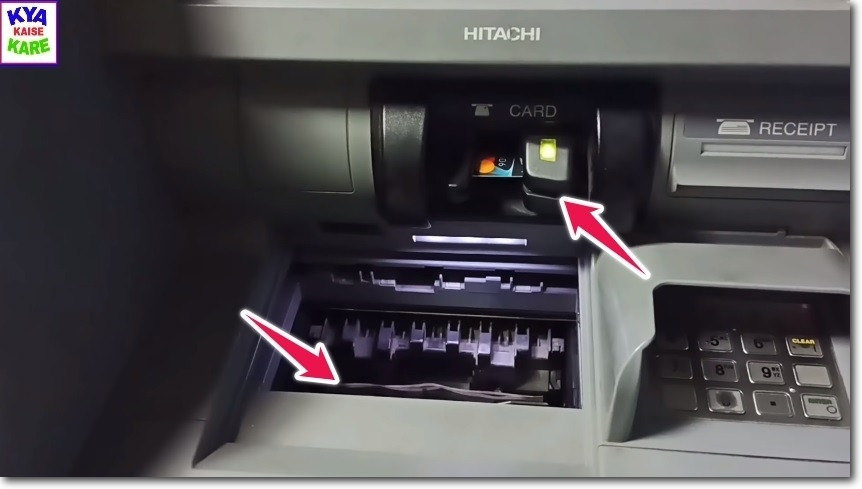

Step 9: Collect your Cash and Your Debit Card

The machine will dispense the cash if 4 conditions are fulfilled and they are,

- There is enough balance in your account.

- Your bank did not decline the transaction.

- The ATM machine has cash in it.

- And the denomination you have selected is available in the machine.

Collect the cash from the machine and also don’t forget to collect your debit card. As soon as the transaction is completed the machine will release your debit card.

In the end before leaving the ATM premises. Throw the receipt in the dustbin. (if you have taken it and want to dispose of it)

To provide you the images I referred to a YouTube video on a channel by the name of Kya Kaise Kare. The credit to the screenshots goes to this channel.

Even you can watch the video above. And if you want to support the creator of the video. Then you can do that by subscribing to the channel.

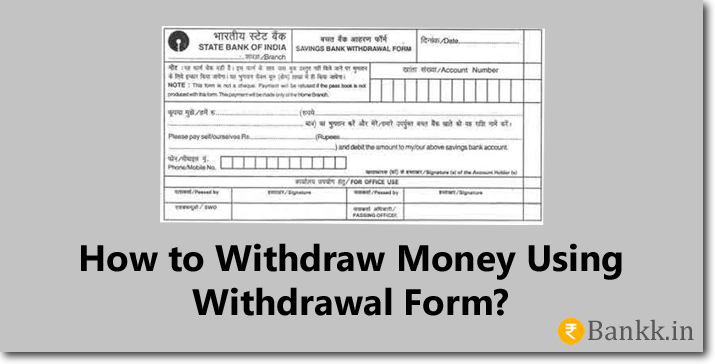

How to Withdraw Money Using Withdrawal Form?

You can withdraw money from your bank account with the help of a withdrawal form. This is one of the oldest methods of getting the money out of the account.

You can perform only a few free cash transactions a month by visiting the branch. On performing more than 3 transactions you will be charged Rs. 40 per cash transaction. 6

Step 1: Get the Withdrawal Form

The first thing you have to do is get the withdrawal form from your bank. You can get this on the official website of your bank and also by visiting the branch of the bank.

In some banks, you can make use of the internet banking portal to get a prefilled withdrawal form. So I recommend you to log in to your internet banking account.

And look for the option of the “Prefilled” form. As I have already told you that not all banks have this feature. But if your bank supports this.

Then enter the amount you want to withdraw and get the printout of the form. This will help you save time during your visit to your home branch.

Step 2: Visit the Branch of the Bank

Visit the branch of your bank and ask for a withdrawal form if you did not get it online. The bank officials will help you out by providing this form.

If you don’t want to ask the bank officials then look for the place where all the forms are kept. Usually, in banks, there will be a separate place where the forms are kept.

Step 3: Fill the Withdrawal Form

Now you have to fill the withdrawal form.

How to Fill Withdrawal Form?

You have to follow the below explained instructions to fill the withdrawal form.

- Mention the Name of Account Holder: The first thing you have to mention in the form is the name of the account holder. That is your name who owns the bank account.

- Mention the Date: The date on which you are withdrawing the money should be mentioned here.

- Name of the Branch: Here you have to mention the name of the branch from where you are withdrawing the money.

- Mention the Account Number: In this section, you will have to fill in your account number. This should be of the account from which you want to withdraw the money.

- Enter the Amount in Words: Now you have to mention the amount you want to withdraw in words.

- Enter the Amount in Number: In this section, you have to enter the amount in numbers.

- Check the Details: Check all the details you have entered in the form. Make sure that all the details are correct to avoid rejections from the bank.

- Sign the Form: At the end, the account holder has to make his or her signature in the space provided.

- Sign on Backside of the Form: It is recommended to make a signature on the backside of the withdrawal Form ask well. This will help the cashier to verify your signature.

Step 4: Submit the form and Collect the Cash

After filling the form go to the cash counter of the branch. And submit your duly filled and signed withdrawal form to the cashier.

The cashier will then enter your account number on his or her computer. This is to check if you have a sufficient balance in your account.

After checking the balance, the cashier will verify your signature with that in the database of the bank. If the signature matches the cashier will approve your request and offer you the cash.

In case of a signature mismatch, the cashier will let you know. He or she will ask you to sign again on the same withdrawal form.

If it matches the money will be deducted from your account. And you will be offered the cash.

You can refer to the YouTube video by a channel by the name Indian Banker video inserted above.

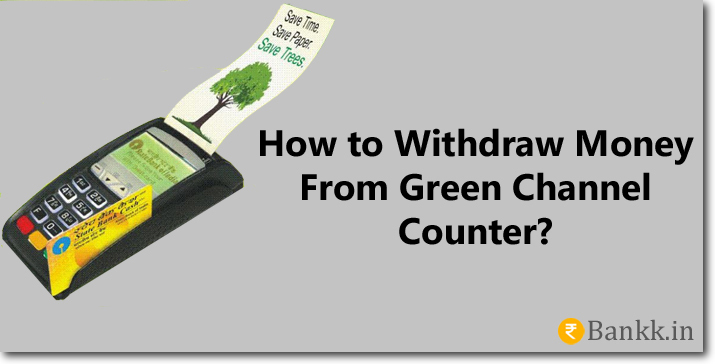

How to Withdraw Money From Green Channel Counter?

If you are a customer of the State Bank of India. Then you can make use of the green channel counter to withdraw money from your bank account.

It has been really long time now since SBI has introduced the green channel counters in its branches. And now this counter can be found in almost all the branches of the bank.

The Green channel counter is not only used for the withdrawal of money. But this counter can be used for deposits and fund transfers as well.

There is a separate machine that is used on this counter. This machine looks very similar to POS Machine. (point of sale) But this machine is not a POS machine.

State Bank of India calls this machine a Transaction Processing Device. 7 If you want to use the green channel counter then there is no need of filling the withdrawal form.

But to use this counter you should have your State Bank of India debit card with you.

To withdraw cash from Bank using the green channel counter. Follow the instructions given below.

Step 1: Visit the Green Channel Counter

The first thing you have to do is visit the green channel counter of the branch. Tell the bank official handling the counter that you want to withdraw money.

The bank official will prepare the machine for cash withdrawal.

Step 2: Insert your Debit Card into the Machine

Give your State Bank of India debit card to the bank official. And he or she will do it for you. If you have a debit card with an EMV chip.

Then your card will be inserted into the machine. And in the case of a normal card with a magnetic stripe. The card will be swiped through the machine.

Step 3: Tell the Amount and Enter your PIN Number

Now tell the bank official the amount of money you want to withdraw. The amount will be entered into the transaction processing device.

And then you have to enter your debit card PIN number.

Step 4: Collect your Debit Card and the Cash

The machine will check if you have sufficient balance. And if yes, then the amount will be deducted from your account.

And the bank official will give you the cash. At last, collect your debit card and the cash.

Currently, the State Bank of India offers this service. But I hope soon the other banks also will introduce similar services to the customers.

You can watch the YouTube video I have inserted above for more clarity. This is a video by a YouTube channel by the name SBPOfficial.

How to Withdraw Money Using Self Cheque?

Despite having so many new technologies that are available to deposit and transfer money. We Indians still use cheques a lot.

You can also use the cheque to withdraw money for yourself as well. Just like how you write a cheque to pay others. You can also write a cheque for yourself.

What is a Self Cheque?

Self cheque is a cheque that the account holder is writing for himself or herself. By writing a self cheque you are instructing your bank to pay you a sum of money from your account.

Where Can I Encash a Self Cheque?

When you write a self cheque you can encash this only from the branch of your bank. And not at any other bank’s branch across India.

For example, let us assume that Ms. Pooja has an account with Canara Bank. And she wants to withdraw money from her account with the help of a self cheque.

After writing the cheque she can withdraw the money from the branch of the Canara Bank. She can not encash the cheque with any branch of State Bank of India, IDFC FIRST Bank, or any other Indian bank.

Is there any Maximum Limit for the Cheque?

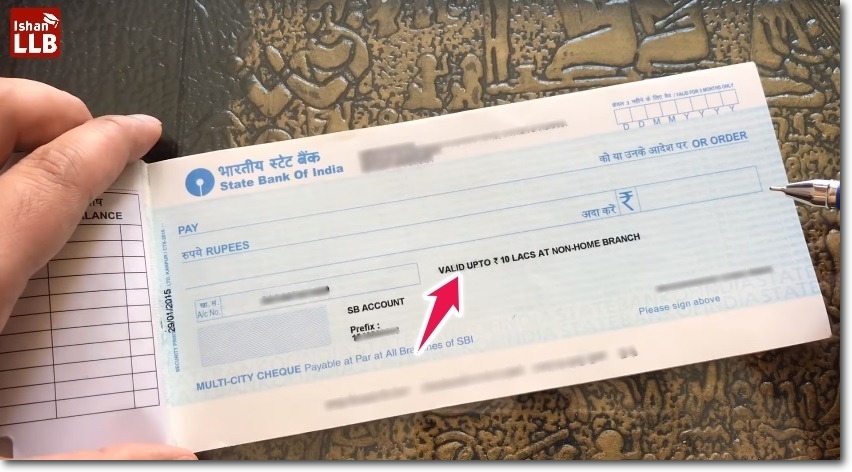

There is no such limit on the maximum amount of money you can withdraw with the help of a cheque. But there is a limit when you are using it at a non-home branch of your bank. (in some cases)

And in some cases, the limit of the transaction depends upon the cheque book you have.

The home branch and non-home branch limit of your cheque will be mentioned on it. While in the case of some banks the cheques are payable at par at all the branches with no limit.

This depends upon your bank and the cheque book you have. That is the reason why I suggest you check the limit mentioned on your cheque.

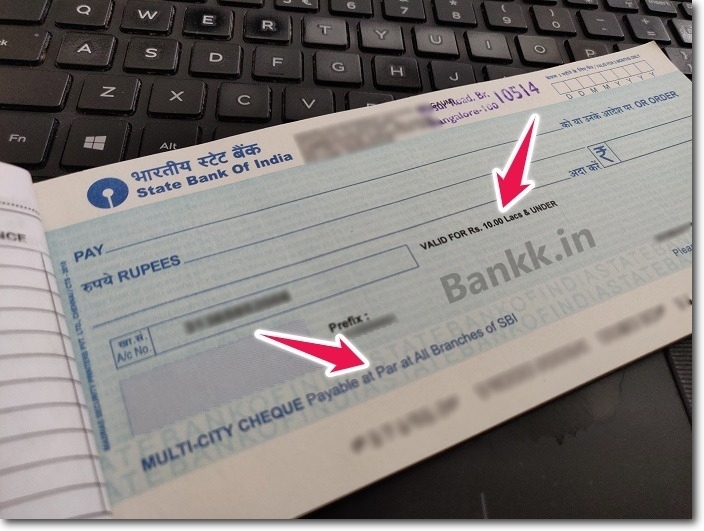

How to Find the Maximum Transaction limit of the Cheque?

To check the limit open your cheque book and have a look at any leaf of the book. If there is any limit it will be mentioned on it.

I have given some examples below.

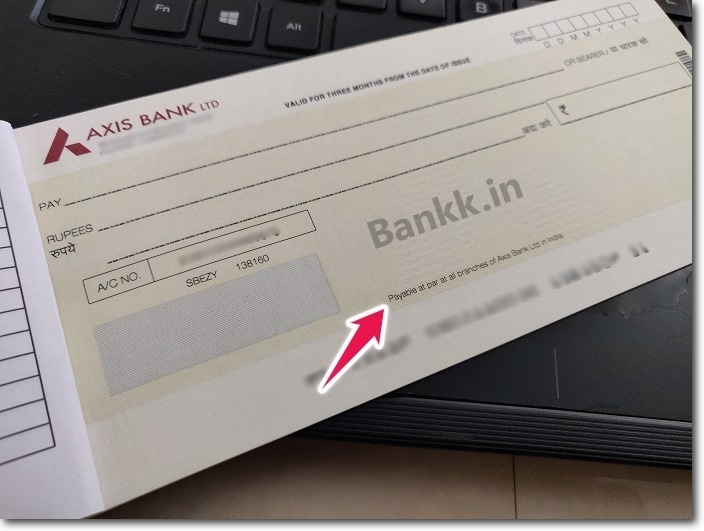

The first example is of an Axis Bank cheque. This cheque says that this is payable at par at all the Axis Bank branches in India. There is no maximum limit that is mentioned in the cheque.

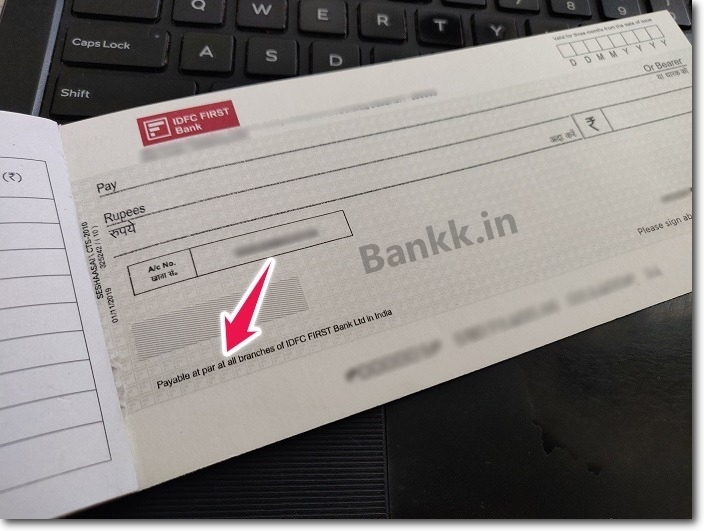

The second example is of IDFC FIRST Bank cheque. Even this cheque says that this is payable at par at all the IDFC FIRST Bank branches. And there is no maximum limit that is mentioned.

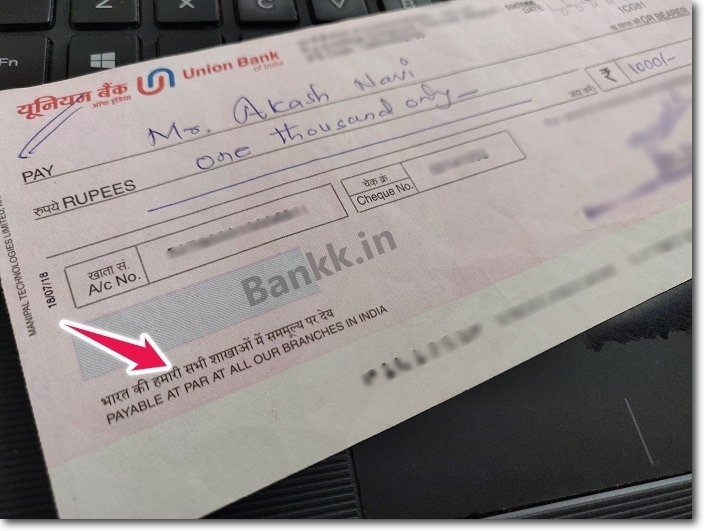

The third example is of Union Bank of India. Even this cheque has it written that it is payable at par at all its branches. An there is no specified maximum limit.

The fourth example is of the largest bank of India. That is the State Bank of India. This cheque says it is payable at par at all the branches of the State Bank of India.

At the same time, it has a maximum limit mentioned on it. It says this cheque is valid for a transaction of Rs. 10,00,00 or less.

All the above-mentioned cheques do not have the non-home branch limit. But we also get such cheques. The above is one of the examples of such cheques.

It says the cheque is valid for a maximum limit of Rs. 10,00,000 at non-home branch.

Ok, now let us learn the steps you need to follow to withdraw money using a self cheque.

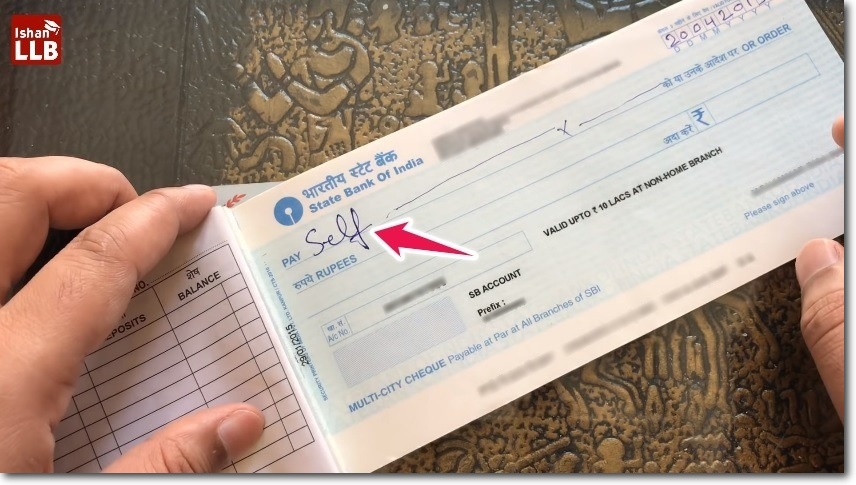

Step 1: Write a Cheque for Self

The first thing you have to do is take out your cheque book and write a self cheque for yourself.

How to write a Self Cheque?

- Mention the Date: First, write the date on which you want to withdraw money from your bank account. The cheque will be valid for 3 months from the date you mention on it.

- Mention Pay Self: This is to tell the bank that you are withdrawing money for yourself using the cheque.

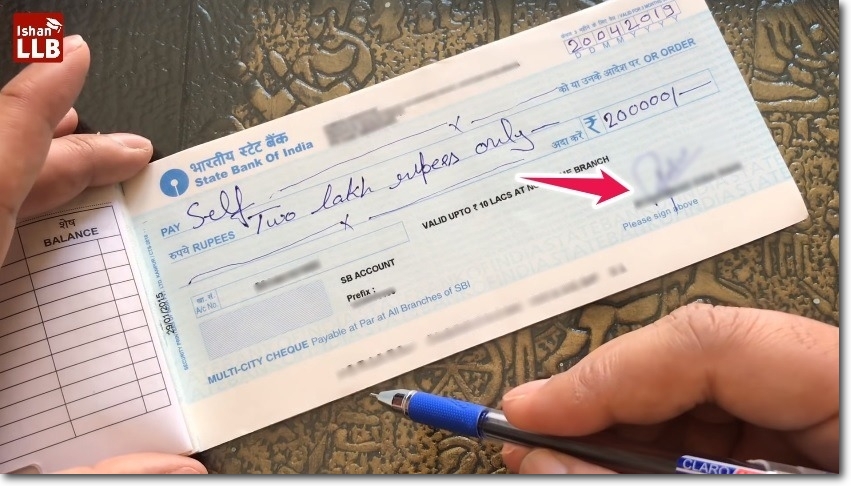

- Write the Amount in Words: Here you have to mention the amount you want to withdraw in words.

- Write the Amount in Numbers: After writing the amount in words, you have to mention the same in numbers.

- Sign the Cheque: After you mention the amount in words. You have to make your signature on the cheque. make sure you do it in the right place. That is above your name on the cheque.

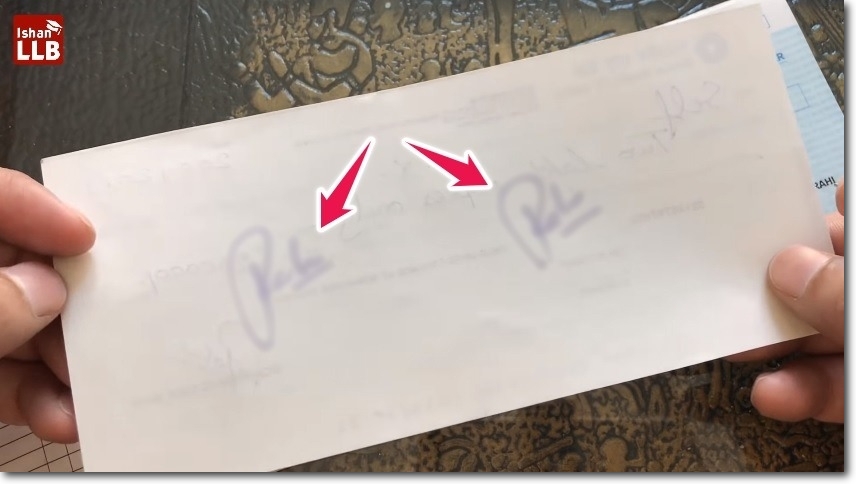

- Sign the Cheque on the Backside: Make two more signatures of yours on the backside of the cheque. The cashier will use these if your signature on the front side does not match.

During my research for this part of the article. I referred to a YouTube video on a channel by the name ISHAN LLB. The above screenshots are also taken from the video.

If you want to support the creator of this video. Then you can do that by subscribing to the channel. You can also watch the video above.

Step 2: Visit the Branch and Go to the Cash Counter

Now as you have written the cheque for yourself to withdraw money from the bank. The next step is to visit the branch of the bank and go to the cash counter.

As it is a self cheque make sure you visit the branch of your bank only. And not that of any other bank.

Step 3: Submit the Cheque and Collect the Cash

Submit the cheque to the cashier. He or she will check the balance in your account. If there is sufficient balance your signature on the cheque will be verified.

The amount you want to withdraw from the bank will be deducted from your account. And the cashier will give you the cash.

There is no requirement to show any of your identity proof documents or bank passbook during this process.

Conclusion

These are some of the various ways by which you can withdraw money from bank. No matter which way you want to follow. Just make sure you are not sharing any of your sensitive account details with anyone.

Foot Notes

1. Minor Savings Account – The Economic Times, Accessed: 24/05/2021

2. Withdrawal of Money from Deceased Person’s Account – Kaanoon, Accessed: 24/05/2021

3. No Negative Balance in Savings Accounts: RBI – The Economic Times, Accessed: 24/05/2021

4. Failed ATM Transaction Due To Insufficient Fund Attracts Penalty – ABP Live, Accessed: 24/05/2021

5. ATM transaction limit: ATM transaction charges by banks in India – Moneycontrol, Accessed: 24/05/2021

6. Financial Express, Accessed: 24/05/2021

7. The Hindu BusinessLine, Accessed: 24/05/2021