Believe me or not the banking innovation that is done in India is way much better than the other countries. And I am telling this on the basis of my study of the banking industry of various western nations.

Where people are still talking about mobile banking. We have things like Unified Payment Interface or the UPI up and running to ease the digital payments experience.

Today we are going to talk about one such amazing innovation by the banks and that is SMS Banking. This thing works great and at the same time, it also saves our time.

So what is it? and How does it work?

That is what exactly we are going to discuss in this article.

What is SMS Banking?

SMS Banking is a part of mobile banking that lets the customers of the bank complete tasks and get information related to their account by sending an SMS with predefined keywords to the bank using their registered mobile number.

There are two kinds of SMSes involved in this and they are Pull SMS and Push SMS.

What are the Different Requests We Can Make?

There are many requests you can make with the help of SMS banking. And they are,

- Checking Account Balance.

- Getting Mini Statement.

- Blocking the Lost or Stolen Debit Card.

- Generating PIN of Debit Card.

- Retrieving the Customer ID.

- Generating MMID.

- Requesting a New Cheque Book.

- Stoping a Cheque Payment, etc.

Some banks let us only check the balance and get the mini statement. Whereas there are some banks which allow the customers to do a lot more stuff.

It depends upon the bank with whom you hold the account. And I have noticed that the banks are slowly adding more and more requests to SMS Banking.

What are the Types of SMS Banking?

I found this on Wikipedia, and there are two types of SMS banking messages that exist. 1

1. Push SMS Banking

These are the SMS which the customer receives from the bank without requesting anything. These involve things like SMS alerts about the transactions happening in the account.

For example, Mr. ABC uses his debit card to withdraw Rs. 5,000 INR from his bank account. Then Mr. ABC will receive an SMS from the bank on your registered mobile number about the same.

Such messages are normally termed as “SMS Alerts” but they are also a part of the SMS Banking infrastructure of the bank.

2. Pull SMS Banking

This is when the customer uses the SMS banking keywords to complete a task or get information. What I mean is when there is the initiation by the customer and the bank sends him or her an SMS is called Pull SMS Banking.

But now many may say that even in the above example of withdrawing the money. There is an initiation done by the customer.

That is a different thing, and this is a different thing.

Here what I mean by the term initiation is the customer sending an SMS with a keyword in it to the bank.

For example, Mr. XYZ wants to receive the mini statement of his bank via SMS. So he types in a message with the keyword and sends the message to the bank.

Then he will receive an SMS back from his bank almost instantly which will contain the mini statement of his account.

What is SMS Banking Keyword?

SMS Banking keyword is a predefined message format that the customer has to type. And send to the bank to complete a certain task or request some information.

This keyword is defined by the bank and is published on its official website.

If the keyword is not typed properly in the message then the bank’s system will not respond to the message.

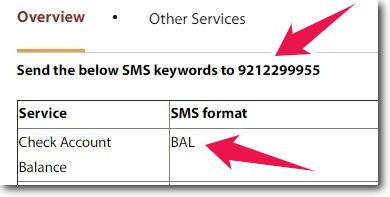

For example, let us assume that I hold an account with IndusInd Bank. And I want to check my account balance with the help of SMS Banking.

So first I will have to visit the official website of IndusInd Bank and check the SMS keywords. Even the phone number to which I have to send the SMS will also be mentioned on the website of the bank.

As you can see in the screenshot above I have to type the SMS as “BAL” and send it to 9212299955.

When I send this SMS the bank’s system will respond and send me my remaining account balance.

How SMS Banking Works?

Almost every bank in India has a well-maintained and robust infrastructure for the purpose of SMS Banking. Let us not get very technical. I will explain things to you in simple layman’s language.

There are 3 things involved here and they are,

- Bank’s System that Receives the messages and Responds to them.

- The keywords or the predefined message formats.

- And the customer smartphone with the registered mobile number in it.

Stage 1: Customer Types the Keyword and Sends the Message

The customer decides what he or she wants to request from the bank. And then looks for the keyword to be used. Once the keyword is found the customer types the message properly.

And send it to the bank’s phone number using his or her registered mobile number.

This phone number which is given by the bank will be mapped or linked with the bank’s automated system. This is the system that receives, interprets, and responds to the customer’s requests.

Stage 2: The Bank’s System Receives the Message and Processes it

As soon as the message is received by the bank’s system, it will interpret it.

First, the system checks if the mobile number from which it has received the SMS is linked to any of its customer’s bank account or not.

If the mobile number is linked then the system will proceed further. If not then the system does nothing but ignores the SMS received.

Then the bank interprets the keyword and checks what is the request that the customer has made. And it pulls the message from its database.

Stage 3: The Customer Receives the Response from the Bank

So far, the customer has selected the keyword, typed the message. And the bank has interpreted the same. Now the bank will send the requested information to the bank.

And in case the customer has requested some task to be done. Then it will do it and send a confirmation to the customer.

This is how the system works: Customer Selects Keyword → Send the SMS → Bank’s System will Process the Request → The Customer will Receive the Response.

All this happens within a minute of time, sometimes if there is too much traffic on the bank’s system it may take longer.

How to Use SMS Banking with Multiple Bank Accounts?

If you have multiple bank accounts with the same bank you can still use this service. But for that, you will have to set or define your primary account.

Most of the banks have a separate keyword to set an account as the primary bank account.

When you do this the bank’s system will send you the information of the primary account when you request any information using the respective keywords.

And in another case, some banks need the account holders to include the account number of their second account in the SMS after a <space> at the end.

This totally depends upon the configuration your bank is using. If you don’t include any account number then you will get the details of your primary account.

And when you include the account number you will get information about the account linked to that number.

SMS Banking Keywords of All Banks

For your convenience, I have listed the keywords of all the banks in one place. All the banks in India which have this facility are mentioned below. Just choose your bank to find its keywords.

Axis Bank

To use Axis Bank SMS Banking you have to send the below-mentioned keyword to +918691000002. The SMS should be sent from your registered mobile number only. 2

| Service | Keyword |

| To get Axis Bank Customer ID | CustID |

| Balance Enquiry | BAL |

| Mini Statement or Last 3 Transactions | MINI |

| Cheque Book Request | CHQBK <space> Last 6 digits of the account number. |

| Stop Cheque Payment | STOPCHQ <space> 6 digit of Cheque No. <space> Last 6 digit of the Account Number <space> 3 Digit Reason Code |

| To Know MMID | MMID |

| To Update PAN Card Number | PAN <space> PAN Number <space> Customer ID |

| To Update Email ID | EMAIL <space> Email Address |

Bandhan Bank

To use Bandhan Bank SMS Banking use the following keywords. And send the SMS to 9223011000 from your registered mobile number. 3

| Service | Keyword |

| Register your Mobile Number for SMS Banking | REG <space> Account Number |

| De-registred from SMS Banking | DEREG <space> Account Number |

| Balance Enquiry | BAL <space> Account Number |

| Mini Statement | MINI <space> Account Number |

| Cheque Book Request | CHQBOOK <space> Account Number |

| Stop Cheque Payment | CHQSTOP <space> Account Number <space> Cheque Number |

| Cheque Status | CHQSTATUS <space> Account Number <space> Cheque Number |

Bank of Baroda

To use Bank of Baroda SMS Banking, use the keywords mentioned below. And send the SMS to 8422009988 from your registered mobile number. 4

| Service | Keyword |

| Balance Enquiry | BAL <space> Last 4 digits of Account Number |

| Mini Statement | MINI <space> Last 4 digits of Account Number |

| Cheque Status | CHQ <space> Last 4 digits of Account Number <space> Cheque Number |

| Subscribe to SMS Alert Facility | ACT <space> Last 4 Digits of Account Number |

| Unsubscribe from SMS Alert Facility | DEACT <space> Last 4 Digits of Account Number |

| Block Debit Card with Debit Card Number | BLOCK <space> C <space> Last 4 Digits of Bank Account Number |

| Block Debit Card with Account Number | BLOCK <space> A <space> Last 4 Digits of Account Number |

Bank of Maharashtra

To use BOM SMS Banking, type the keyword and send the SMS to 9223181818 from your registered mobile number. 5

| Service | Keyword |

| Balance Enquiry | BALAVL <space> Account Number <space> SMS MPIN |

| Mini Statment or Last 3 Transactions | LATRAN <space> Account Number <space> SMS MPIN |

| Chaneg MPIN | CHGPIN <space> Old MPIN <space> New MPIN |

| Cheque Status | Cheque Number <space> Account Number <space> MPIN |

| Link Aadhaar Card | SEED <space> Aadhaar Card Number <space> Account Number |

Central Bank of India

To use Central Bank of India SMS Banking service. Send the SMS with the respective keyword to 9967533228 from your registered mobile number. 6

| Service | Keyword |

| Balance Enquiry | BALAVL <space> Account Number <space> MPIN |

| Mini Statement or Last 5 Transactions | LATRAN <space> Account Number <space> MPIN |

| Change MPIN | CHG <space> New MPIN <space> Old MPIN |

| Generate MMID | MMID |

| Cheque Status | CHQSTS <space> Cheque Number <space> MPIN |

DCB Bank

To use DCB Bank SMS Banking, you have to send the respective keyword to 9821878789 using your registered mobile number. 7

| Service | Keyword |

| Register for SMS Banking Facility | REG |

| Get all Keywords via SMS | H |

| Balance Enquiry | BAL |

| Mini Statement of Last 5 Transactions | STMT |

| Cheque Book Request | CHQBOOK |

| Cheque Status | STAT <space> Cheque Number |

| Stop Cheque Payment | STOP <space> Cheque Number |

| Block Debit Card | BLOCK DC <space> Last 4 Digits of Debit Card Number |

Dhanlaxmi Bank

To use the Dhanlaxmi Bank SMS Banking service, choose the keyword below. And send it to 5676751 using your registered mobile number. 8

| Service | Keyword |

| Credit Card Details | CC |

| Gold Loan Details | GOLD |

| Car Loan Details | CL |

| Offers | OFFER |

| SME Banking | SME |

| Generate MMID | MMID <space> Customer ID |

| Cancel MMID | MMIDCANCEL <space> Customer ID |

Federal Bank

To use Federal Bank SMS banking, you have to choose the keyword. And sent it to 9895088888 using your registered mobile number. 9

| Service | Keyword |

| Balance Enquiry | BAL |

| Mini Statement or Last 10 Transactions | TXN |

| Cheque Status | CPS <space> Short Number <space> Cheque Number |

| Cheque Book Request | CBR <space> Last 4 Digits of Account Number |

| Generate MMID | MMID |

HDFC Bank

If you want to use the HDFC Bank SMS Banking service. Then you will have to send the keyword to 5676712 from your registered mobile number. 10

| Service | Keyword |

| Register for SMS Banking Facility | REGISTER |

| Balance Enquiry | BAL |

ICICI Bank

You can use the ICICI Bank SMS Banking by sending the keyword to 9215676766 from your registered mobile number. 11

| Service | Keyword |

| Balance Enquriy | IBAL |

| Mini Statement | ITRAN |

| Cheque Status | ICSI <space> Cheque Number |

| Cheque Book Request | ISCR <space> Cheque Number |

IDBI Bank

You can use IDBI Bank SMS Banking by sending the keyword to 9820346920 from your registered mobile number. 12

| Service | Keyword |

| Balance Enquiry | BAL <space> Customer ID <space> PIN |

| Mini Statement or Last 3 Transactions | TXN <space> Customer ID <space> PIN |

| Change PIN | CPN <space> Customer ID <space> OLD PIN <space> NEW PIN |

IDFC FIRST Bank

To use the IDBI FIRST Bank SMS Banking services, you have to choose the keyword. And send it to 9289289960 you have to send the SMS from your registered mobile number only. 13

You can type the last 4 digits of your account in case of multiple accounts with IDFC FIRST Bank.

| Service | Keyword |

| Balance Enquiry | BAL |

| Mini Statement or Last 5 Transactions | TXN |

| Cheque Book Request | CHQK <space> Last 4 Digits of Account Number |

| Stop Cheque Payment | CHQSTOP <space> Account Number <space> Cheque Number |

| Block Debit Card | BLOCK <space> Last 4 Digits of Account Number |

| List of Keywords | HELP |

Indian Bank

If you want to use the Indian Bank SMS Banking facility. Then choose the keyword from the below table and send it to 9444394443 using the mobile number that is registered with your bank account. 14

| Service | Keyword |

| Balance Enquiry | BALAVL <space> Account Number <space> MPIN |

| Mini Statement or Last 3 Transactions | LATRAN <space>Account Number <space> MPIN |

| Cheque Status | CHQSTS <space> Cheque Number <space> Account Number <space> MPIN |

| Change MPIN | CHGPIN <space> New MPIN <space> Old MPIN |

| List of Keywords | HELP |

Indian Overseas Bank

You can use IOB SMS Banking facility by sending the keyword of your choice from the below table to 8424022122. 15

| Service | Keyword |

| Balance Enquiry | BAL <space> Last 4 Digits of Account Number |

| Mini Statement | MINI <space> Last 4 Digits of Account Number |

| Generate MMID | MMID |

IndusInd Bank

To use IndusInd Bank SMS Banking Services, select the right keyword and send it to 9212299955. 16

If you have multiple accounts with IndusInd Bank. Then the last opened account will be considered for all the requests you make.

| Service | Keyword |

| Balance Enquiry | BAL |

| Mini Statement | MINI |

| Generate MMID | GETMMID |

Karnataka Bank

Select the keyword and send it to 9880654321 using your registered mobile number to use SMS Banking services of Karnataka Bank. 17

If you have not completed the KYC of your account then you can not use this facility. So if you have not done it yet. Then visit your home branch.

If you have already completed the Full KYC of your account. Then you are all set to use this facility.

| Service | Keyword |

| Balance Enquiry | BAL <space> Account Number |

| Mini Statement | TRN <space> Account Number |

| FD Account Enquiry | FDE <space> FD Account Number |

| Loan Account Enquiry | LON <space> Loan Account Number |

| Generate MMID | MMID <space> Account Number |

| Cheque Status | CPS <space> Account Number <space> Cheque Number |

| Cheque Book Request | CBR <space> Account Number |

| Stop Cheque Payment | STP <space> Account Number <space> Cheque Number |

Kotak Mahindra Bank

Kotak Mahindra Bank customers can use the SMS Banking Facility by sending the keyword via SMS to 9971056767 from their registered mobile number. 18

| Service | Keyword |

| Balance Enquiry | BAL |

| Mini Statement or Last 3 Transaction | TXN <space> Last 4 Digits of Account Number |

| Cheque Status | CHQSTATUS <space> Account Number <space> Cheque Number |

| Cheque Book Request | CHQBOOK <space> Last 4 Digits of Account Number |

| Generate MMID | MMID <space> Last 4 Digits of Account Number |

| Cancel MMID | MMIDREVOKE <space> MMID Number |

Punjab and Sind Bank

If you hold an account with Punjab and Sind Bank and want to use the SMS Banking facility. Then choose the keyword from the below table. Type it correctly and send it to 9223815844 from your registered mobile number. 19

At the end of the SMS, you also have to mention your SMS password. If you are using the facility for the first time and don’t have your SMS password with you.

Then you can set it using the internet banking portal of Punjab and Sind Bank. The option to set this password can be found under the “Preferences” menu.

| Service | Keyword |

| Balance Enquiry | PBAL <space> Account Number <space> SMS Password |

| Mini Statement of Last 3 Transaction | PTXN <space> Account Number <space> SMS Password |

| Cheque Status | PCHQ <space> Cheque Number <space> Account Number <space> SMS Password |

| Block Debit Card | LOST <space> Account Number |

Punjab National Bank

Punjab National Bank or PNB customers can use this service by sending the keyword to 5607040 using their registered mobile number. 20

There is no need for separate registration for the PNB customers. This facility is active by default. But you can use this service only if your number is registered with your account.

If not then you can visit your home branch to get it registered.

| Service | Keyword |

| Balance Enquiry | BAL <space> Account Number |

| Mini Statement | MINSTMT <space> Account Number |

| Cheque Status | CHQINQ <space> Cheque Number <space> Account Number |

| Stop Cheque Payment | STPCHQ <space> Cheque Number <space> Account Number |

RBL Bank

To use the RBL Bank SMS banking facility first you will have to register yourself. You can do that by sending an SMS as “REG” to 9223366333. Once you have registered you can use this facility. And if you want to stop using this service or de-register then send an SMS as “DREG”. 21

If you have multiple bank accounts. Then you can change your primary account. To do that type SET <space> Customer ID <space> Account number.

| Service | Keyword |

| Register for SMS Banking Facility | REG <space> Customer ID |

| De-registerd from SMS Banking Facility | DREG <space> Customer ID |

| Balance Enquiry | BAL <space> Customer ID |

| Mini Statement or Last 5 Transactions | TXN <space> Customer ID |

| Cheque Status | CHQSTA <space> Customer ID <space> Account Number <space> Cheque Number |

| To Get RBL Bank Customer ID | CIF |

| List of Keywords | HELP |

Saraswat Bank

You can choose the keyword from the below table and send it to 9223810000 to use Saraswat Bank SMS Banking Facility. 22

In the case of multiple accounts, you can enter the account number of your required account at the end. This will help you to get the details of your account of choice.

Please note that there should be only one <space> between all the syntax. And you can get information about only your accounts that are linked to your account. So don’t try to enter any other account numbers.

| Service | Keyword |

| Balance Enquiry | SBAL <space> Account Number |

| Mini Statement or Last 5 Transactions | LST5 <space> Account Number |

| Block Debit Card | BLOCK <space> Last 4 Digits of Card Number |

| Stop Cheque Payment | STOPCHQ <space> Account Number <space> Cheque Number |

| To Update Email ID | EMAILD <space> Your Complete Email ID |

State Bank of India

All the SBI SMS Banking keywords are given below. There are different phone numbers to be used for some of the services. So I have mentioned the keyword along with the phone number to which you have to send the SMS.

| Service | Keyword |

| Balance Enquiry | BAL to 9223766666 |

| Mini Statement | MSTMT to 9223766666 |

| Cheque Book Request | CHQREQ to 9223588888 |

| Block Debit Card | BLOCK <space> Last 4 Digits of the Card to 567676 |

| Register for SMS Banking Facility | REGISTER <space> Account Number to 9223488888 |

UCO Bank

To use UCO Bank SMS Banking, you will have to send the SMS containing the keyword to 9230192301. 23

| Service | Keyword |

| Block Debit Card | HOT <space> Last 4 Digits of the Card Number |

Union Bank of India

You can use Union Bank of India SMS Banking, by sending the keywords to 09223008486 from your registered mobile number. 24

In case of more than one account add a <space> and type the account number. If you don’t mention any account number at the end. Then you will receive information about your primary account.

| Service | Keyword |

| Balance Enquiry | UBLOCK <space> Last 4 Digits of the Card Number |

| Mini Statement | UMNS |

| Cheque Status | UCSR <space> Cheque Number |

| Link Aadhaar Card | UID <space> Account Number <space> Aadhaar Card Number |

Yes Bank

To use the Yes Bank SMS Banking facility you have to select the keyword, type it, and sent it to 9840909000 using your registered mobile number. 25

If you have more than one account with Yes Bank, then you will have to add a <space> and account number at the end of the message.

Example, YESBAL <space> Customer ID <space> Account Number

| Service | Keyword |

| Register for SMS Banking Facility | YESREG <space> Customer ID |

| Balance Enquiry | YESBAL <space> Customer ID |

| Mini Statement of Last 5 Transactions | YESTXN <space> Customer ID |

| Cheque Status | YESCST <space> Customer ID <space> Cheque Number |

| Stop Cheque Payment | YESSTP <space> Customer ID <space> Cheque Number |

| List of Keywords | YESHELP <space> Customer ID |

Standard Chartered Bank

All the account holders of the Standard Chartered Bank can use the SMS Banking facility by sending the right keyword to 9987123123 using their registered mobile number. 26

For multiple linked accounts, please add an alias (A1, etc.) after the keyword. e.g. BAL A1.

| Service | Keyword |

| Balance Enquiry | BAL |

| Mini Statement | TXN |

| Cheque Book Request | CBR |

| Account Statement Request | STR |

| List of Keywords | HELP |

Ujjivan Small Finance Bank

You can use Ujjivan Small Finance Bank’s SMS Banking Facility by sending the keyword to 9243232121. But the SMS has to be sent from the registered mobile number only. 27

If you have more than one account with Ujjivan Small Finance Bank. Then you will have to add a <space> and enter the last 4 digits of your second account to get its information.

| Service | Keyword |

| Balance Enquiry | BAL |

| Mini Statement | MIN |

| To Get Ujjivan Small Finance Bank Customer ID | CUST |

| Cheque Book Request | CBR |

| Cheque Status | CHQ <space> Cheque Number <space> Last 4 Digits of Account Number |

Suryoday Small Finance Bank

You can use Suryoday Small Finance Bank’s SMS Banking Facility by sending the keyword to 9741000040 using your registered mobile number. 28

If you have multiple accounts with Suryoday Small Finance Bank. Then you change your primary account. You will receive the information of the account which you select as your primary account for this service.

| Service | Keyword |

| Register for SMS Banking Facility | REG |

| De-register from SMS Banking Facility | DEREG |

| Balance Enquiry | BAL |

| Mini Statement | MINI |

| Cheque Book Request | CHQBOOK |

| Cheque Status | CHQSTATUS <space> Cheque Number |

| Block Debit Card | HOT <space> Account Number <space> Last 4 Digits of the Debit Card Number |

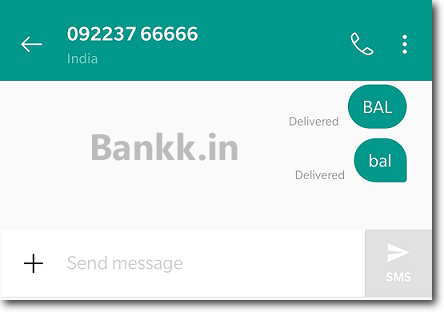

Are the Keywords Case Sensitive?

No, keywords of SMS banking are not case sensitive. You just have to send the right keyword to receive a proper response from the bank.

To understand this I ran the test myself using my State Bank of India account. First I sent the SMS with all letter capital and then the second message with all letters small.

But still, I got a response from the bank, this proves that these keywords are not case sensitive. I tried the same with IDFC FIRST Bank and Axis Bank too.

So if we consider this sample test to be true for all the Indian banks. Then we can conclude that the keywords are not case sensitive.

Will the Bank Charge me For this Service?

No, the banks usually don’t charge you for this service. But however, your telecom service provider may charge you as per your plan for each SMS you send.

I called the customer are of the State Bank of India to verify this information.

But I also read on the internet that the bank is charging for the SMS alerts as much as Rs. 60 INR per year per bank account. 29

There is a difference between SMS alerts and SMS banking. But in case if your bank considers both the same then you might be getting charged once per year.

The best thing you can do to get this information is to call the customer care of your bank. But if you are a customer of the State Bank of India. Then you won’t be charged anything for SMS banking and missed call banking services.

Why I am not Receiving any Response? (SMS Banking Error)

If you are not receiving any response from your bank then there are 3 different reasons why this might be happening. Let me explain these one-by-one to you.

1. You Might have to Get Registered First

Some banks require their customers to register for the SMS Banking facility separately. So check if you have got yourself registered for this service.

If not then first send the SMS to the bank to get registered, and then you will receive correct responses from the bank.

Some banks which require registration: Bandhan Bank, DCB Bank, HDFC Bank, and RBL Bank, etc.

2. You Might have Done a Typing Mistake

Check if you have typed the right keyword, if you have a typing mistake then you will not receive any response from the bank.

Some banks send you an SMS telling you that you have typed the wrong keyword. Whereas some banks don’t send any response at all.

So if you are not receiving a response from the bank. You should first check if you have done any typing mistakes. This applies to the bank’s phone number, keyword, and also to your SMS Password or MPIN. (if your bank requires it)

3. You Might have not Sent the SMS from your Registered Mobile Number

To receive a proper response from the bank you have to send the SMS from your registered mobile number only. If you are sending it from any other mobile number.

Then you will not receive any response from the bank. So make sure you are sending it from the mobile number which is registered with your bank account.

This error happens when you are using a dual SIM card smartphone.

Conclusion

This is everything you should know about SMS Banking, how it works, how to use it, and also the keywords of all the Indian Banks.

Footnotes

1. Wikipedia, Accessed: 15/05/2021

2. Keywords and Instructions – Axis Bank, Accessed: 15/05/2021

3. Bandhan Bank, Accessed: 15/05/2021

4. Bank of Baroda, Accessed: 15/05/2021

5. Bank of Maharashtra, Accessed: 15/05/2021

6. Central Bank of India, Accessed: 15/05/2021

7. Key SMS Texts – DCB Bank, Accessed: 15/05/2021

8. Dhanlaxmi Bank, Accessed: 15/05/2021

9. Federal Bank, Accessed: 15/05/2021

10. HDFC Bank, Accessed: 15/05/2021

11. ICICI Bank, Accessed: 15/05/2021

12. IDBI Bank, Accessed: 15/05/2021

13. IDFC FIRST Bank, Accessed: 15/05/2021

14. Indian Bank, Accessed: 15/05/2021

15. Indian Overseas Bank, Accessed: 15/05/2021

16. IndusInd Bank, Accessed: 15/05/2021

17. Karnataka Bank, Accessed: 15/05/2021

18. Kotak Mahindra Bank, Accessed: 15/05/2021

19. Punjab and Sind Bank, Accessed: 15/05/2021

20. Punjab National Bank, Accessed: 15/05/2021

21. RBL Bank, Accessed: 15/05/2021

22. Saraswat Bank, Accessed: 15/05/2021

23. UCO Bank, Accessed: 15/05/2021

24. Union Bank of India, Accessed: 15/05/2021

25. Yes Bank, Accessed: 15/05/2021

26. Standard Chartered Bank India, Accessed: 15/05/2021

27. Ujjivan Small Finance Bank, Accessed: 15/05/2021

28. Suryoday Small Finance Bank, Accessed: 15/05/2021

29. Business Today, Accessed: 15/05/2021