If you have lost your ATM Card or Debit Card then the first thing you should do is block it. Blocking the card is very important because it will ensure that the card will not be used by anyone for making any transactions. It is not a hard task to block the card if you have lost it somewhere or if it is stolen.

I have explained how you can block the card as soon as possible to keep your bank account balance safe and sound. There are various methods by following which you can block your lost debit card. I have explained the steps to block the ATM Card of all the major banks that are operating in India.

What are the Methods to Block the ATM Card?

There are various methods to block the lost card which are mentioned below.

Using Internet Banking: Go to the official website of your bank and sign in to your internet banking account. After you sign in look for “ATM Card Services”. Select the card which you have lost and click on the “Block” button to block the card.

Using Mobile Banking: Download and Install the official mobile banking app of your bank. Sign-in into the app tap look for “ATM Card Services”. All the ATM Cards that are linked to your bank account will be displayed to you on the screen. Select the ATM card you wish to block and tap on the “Block” button.

By Sending SMS: There are different SMS banking keywords for every bank. Find the keyword of your bank. Type the SMS and send it from your registered mobile number to block the lost card. You can find the SMS Banking keywords of your bank on its official website.

By Calling the Customer Care: Find out the customer care number of your bank. Call customer care and use the IVR option to block the lost card. Using the IVR option you will be able to block the card if you are calling from your registered mobile number. If you don’t have access to your registered mobile number. Then get your call connected to speak with the customer care support executive and take their help.

By Visiting the Bank’s Branch: Find the nearest branch of your bank and give it a visit. Speak with the bank employees, tell the employees that you have lost your ATM Card and want to block it. The employees will help you out in blocking the lost card.

What Happens When the Card is Blocked?

When you request the bank to block your card the bank will make your card invalid. This means the card can not be used for making any kind of transaction.

Your card can no more be used to withdraw cash from the ATM machine, make online payments or make offline POS payments.

And if in case you have subscribed to any of the services which charge you monthly on your ATM Card or Debit Card. Even those payments will start failing as your card has been made invalid by your bank.

Are there Different Types of Blocking?

Yes, there are two types of blocking of the card and they are temporary blocking and permanent blocking of the card. When you approach our bank to block the card you will get these two options and is totally your choice.

These days almost all the banks offer this option but some of the public sector banks and a few private sector banks don’t offer this option. In such cases, your card will be blocked permanently.

What is the Permanent Blocking of the Card?

If you choose this option your ATM Card will be blocked permanently. This means even if you find the card later on you will not be able to reactivate it or unblock it. The only option left with you is to destroy the lost card and request your bank to issue a new one.

Example: Consider you have misplaced your ATM Card somewhere. As soon as you realize that you don’t have your card you chose to block it permanently. But later on, you find it to be at your workstation. Even after getting it back you can not reactivate and continue using it.

What is Temporary Blocking of the Card?

If you choose to block your card on a temporary basis then you will be able to reactive or unblock the card later on. You will be able to block and unblock your card using internet banking and mobile banking.

Example: Let us assume that you have kept your card at your friend’s home. And you chose to block it on a temporary basis. Later when your friend returns you to the card you can unblock it and continue using it as you did before.

Will the Bank Charge Me to Block the Card?

No, your bank will not charge you anything when you request it to block your lost or stolen card. This will be done for free of cost. But you will have to pay the annual maintenance charges to your bank for the usage of the card for the year.

Will the Bank Charge Me for the Replacement Card?

In some cases yes the bank will charge you for the replacement card. This depends upon the policies for your bank and the type of account you hold with the bank.

When you get in touch with your bank to block the card you can ask them about the replacement charges.

I have an account with the State Bank of India and they charge for the replacement card. While I have a secondary bank account with IDFC FIRST Bank they don’t charge me for the replacement card.

What Happens If Lost Card is Not Blocked?

By not blocking your lost card you are putting your bank account in danger. If in case any person finds your card and uses it somewhere then you will be one losing the money.

Now you might be thinking about what the person can do without knowing the ATM PIN Number.

But let me tell you that the card can be used without the PIN number as well. If you have contactless payments enabled on your card.

Then all the person has to do is make the purchase and just tap your card on the POS machine. If this kind of event happens then you will lose your money.

This is not the only way you can lose money. There is one more and that is using the international shopping sites and payment gateways.

Sometimes when the payment is done on any international shopping sites you won’t receive the OTP from your bank. In such cases, all you need to enter is your card number, name, expiry date, and CVV.

Hence it is highly recommended that you block your card as soon as possible. In fact, you should block it quickly after you realize your card has been lost or stolen.

Steps to Block the Lost ATM Card or Debit Card of All Indian Banks

I have explained below the steps to block the ATM Card of all the major Indian banks. Just select your bank below and follow the procedure to block your lost card successfully.

AU Small Finance Bank

To block your AU Small Finance Bank ATM Card call the customer care of the bank 1800 1200 1200. Use the IVR option to block your card or else speak with a customer care executive. Tell the executive of the bank that you have lost the card and want to block it. The executive of the bank will block your card for you instantly.

Axis Bank

To block your Axis Bank ATM Card type an SMS as “BLOCKCARD” and send the SMS to 5676782 or +919717000002 from your registered mobile number. 1

Bandhan Bank

You can block your Bandhan Bank ATM Card by calling the customer care of the bank on 18002588181. This is a toll-free number. Speak with one of the bank’s customer care executives and get the card blocked instantly.

Bank of Baroda

To block your Bank of Baroda ATM Card type an SMS as SMS BLOCK C XXXX and send it to 8422009988 from your registered mobile number. Replace XXXX with the last 4 digits of your lost card.

Bank of India

You have to call the customer care of Bank of India on 1800 22 0229 and use the IVR option to block your lost card immediately. 2

Bank of Maharashtra

Bank of Maharashtra customers can block the card you have to give a call to the customer care of the bank on 1800 233 4526. Tell the customer care representative that you have lost your card and want to get it blocked. 3

Canara Bank

To block your Canara Bank ATM Card type an SMS as “CAN HOTLISTDC XXXX” and send the SMS to 5607060. Replace XXXX with your ATM Card number. This SMS has to be sent from your registered mobile number only. 4

Central Bank of India

You can block your Central Bank of India ATM Card by sending an SMS from your registered mobile number. Type an SMS as LOST XXXX and send it to 9967533228. Replace XXXX with your Central Bank of India account number. 5

City Union Bank

Give a call to the customer care of City Union Bank on 044 7122 5000. And select the IVR option to block your lost ATM Card or Debit Card. 6

CSB Bank

Call the customer care of the CSB Bank on 1800 266 9090 and select the IVR option to block the lost ATM Card. Your card will be instantly blocked by the bank. 7

DCB Bank

You have to call the customer care of the DCB Bank on 1800 209 5363 to block your lost card. Either choose the IVR option or speak with the customer care executive. The bank will block your card instantly after receiving your request. 8

Dhanlaxmi Bank

You have to call the customer care of the Dhanlaxmi Bank on 0487 6613000 and inform the bank that you have lost your card. Upon getting the information from your about the loss of the card. The bank will block your card instantly. 9

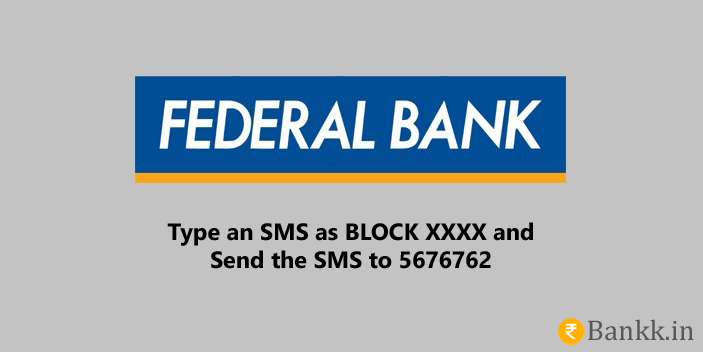

Federal Bank

To block your Federal Bank ATM Card type an SMS as BLOCK XXXX and send it to 5676762. Replace XXXX with the last 4 digits of your lost Federal Bank ATM Card. 10

HDFC Bank

Login to your HDFC Bank internet banking → Open Debit Card Hotlisting Section → Select Your Lost Debit Card → Click on Block. If you don’t have access to internet banking then you can use the mobile banking app of the bank. In case you don’t have both then call the customer care of the bank. 11

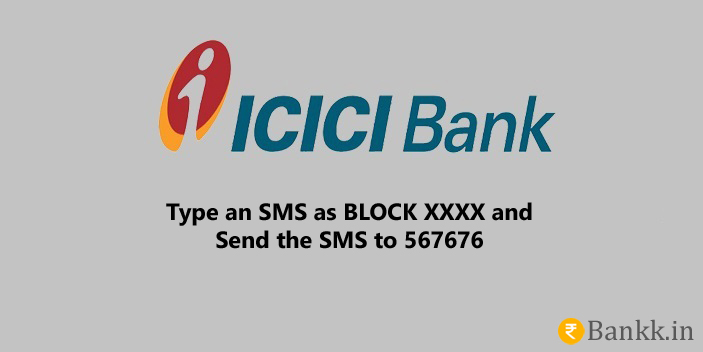

ICICI Bank

To block your ICICI Bank ATM Card type an SMS as BLOCK XXXX and send it to 567676. You have to replace XXXX with the last 4 digits of your lost card number. Please keep in mind that this SMS has to be sent from the registered mobile number only. 12

IDBI Bank

If you have lost your IDBI Bank ATM Card then call the customer care of the bank on 1-800-22-6999. And report about your loss of the card. The bank will block your card immediately to avoid the chances of misuse of your card. 13

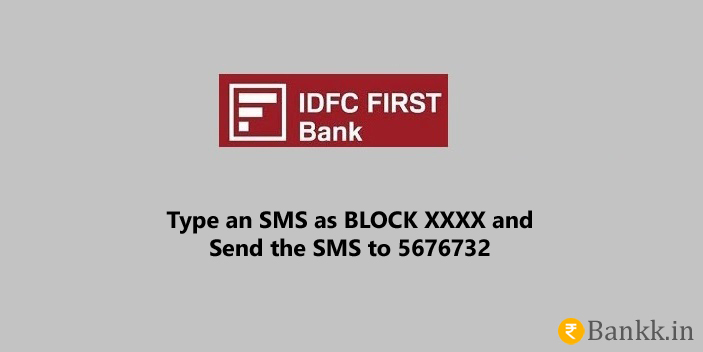

IDFC FIRST Bank

To block your lost IDFC FIRST Bank ATM Card you have to send an SMS from your registered mobile number. Type an SMS as BLOCK XXXX and send it to 5676732. Replace XXXX with the last 4 digits of your ATM Card that you have lost or misplaced. 14

Indian Bank

You can block your Indian Bank ATM card by calling customer care on 1800 4250 0000. You have to report the loss of your card and the bank will block your card immediately.

Indian Overseas Bank

To block your Indian Overseas Bank ATM Card you have to call customer care on 18004254445 and follow the IVR instructions. 15

IndusInd Bank

Call the customer care of IndusInd Bank on 1860 500 5004. You can use the IVR options to block the card or speak with the executive of the bank. Report about your loss of the card and the executive will get the card blocked for you. 16

Jammu and Kashmir Bank

To block your J&K Bank ATM Card you have to call the customer care of the bank and report about your loss. Call customer care on +91-194-2713333 and speak with the support executive to report your lost card. Once the card is blocked it can not be used to make any transactions by anyone. 17

Karnataka Bank

To block your lost or stolen Karnataka Bank ATM Card you have to send an SMS to the bank. Type BLOCK XXXX and send it to 9880654321. Here XXXX needs to be replaced with the last 4 digits of the lost card. 18

Karur Vysya Bank

To block your KVB ATM Card you have to send an SMS to the bank from your registered mobile number. Type an SMS as KVB XXXX BLOCK and send it to 9244770000. Replace XXXX with the last 4 digits of your ATM Card number.

How Can I Find the Last 4 Digits of My Lost ATM Card?

In the case of most banks, you have to send an SMS from your registered mobile number. But here you have to mention the last 4 digits of your ATM Card which is lost.

If you remember your card number then that is fine. But if you don’t remember then you can use the internet banking portal of your bank.

Just log in and go to the ATM Cards section of the portal where you can find the last 4 digits of your ATM Card. If you have the mobile banking app installed then you can use the app too.

| Bank’s Name | Process to Block the Card |

| AU Small Finance Bank | Call customer care on 1800 1200 1200 and report the loss of the card. |

| Axis Bank | Send an SMS as BLOCKCARD to 5676782 |

| Bandhan Bank | Call customer care on 18002588181 and report the loss of the card. |

| Bank of Baroda | Send an SMS as BLOCK C XXXX to 8422009988 |

| Bank of India | Call customer care on 1800 22 0229 and report the loss of the card. |

| Bank of Maharashtra | Call customer care on 1800 233 4526 and report the loss of the card. |

| Canara Bank | Send an SMS as CAN HOTLISTDC XXXX to 5607060 |

| Central Bank of India | Send an SMS as LOST XXXX to 9967533228 |

| City Union Bank | Call customer care on 044 7122 5000 and report the loss of the card. |

| CSB Bank | Call customer care on 1800 266 9090 and report the loss of the card. |

| DCB Bank | Call customer care on 1800 209 5363 and report the loss of the card. |

| Dhanlaxmi Bank | Call customer care on 0487 6613000 and report the loss of the card. |

| Federal Bank | Send an SMS as BLOCK XXXX to 5676762 |

| ICICI Bank | Send an SMS as BLOCK XXXX to 567676 |

| IDBI Bank | Call customer care on 1-800-22-6999 and report the loss of the card. |

| IDFC FIRST Bank | Send an SMS as BLOCK XXXX to 5676732 |

| Indian Bank | Call customer care on 1800 4250 0000 and report the loss of the card. |

| Indian Overseas Bank | Call customer care on 18004254445 and report the loss of the card. |

| IndusInd Bank | Call customer care on 1860 500 5004 and report the loss of the card. |

| Jammu and Kashmir Bank | Call customer care on +91-194-2713333 and report the loss of the card. |

| Karnataka Bank | Send an SMS as BLOCK XXXX to 9880654321 |

| Karur Vysya Bank | Send an SMS as KVB XXXX BLOCK to 9244770000 |

Note: Wherever XXXX is there you have to replace it with the last 4 digits of your ATM Card number. And wherever the customer care number is mentioned you can use the IVR or speak with the support executive of the bank.