There are a lot of ways to pay someone money or carry out a transaction. But when you don’t have time or want to carry out a transaction quickly.

You will need the mode of payments that will work very fast, really fast. This is the need and to satisfy this need our banks have come up with Contactless payments.

This mode of payment using the card helps to save a lot of time. If you want to make payments then you can do it just by tapping your card on the POS machine.

This is not only limited to the POS machines. You can do payments to any financial device that has NFC and supports the contactless payment technology.

Today we will learn everything about contactless payments technology. And also the process that you have to follow to enable it on your card.

You just can not start using your debit card or credit for contactless payments. This feature has to be activated or enabled manually by you.

In earlier days the contactless payments were enabled by default for domestic payments. But after an RBI regulation, this feature is disabled by the banks by default.

If the customers want to have this feature and use it. Then the customer has to get this feature enabled for his or her card.

What are Contactless Payments?

This is a new way of making payments with the help of your debit cards or credit cards. Instead of you swiping your card into the POS machine and entering your PIN Number.

You just need to tap your card on the POS machine. Your payment will be processed by the bank. And the money will be deducted from your account balance.

It is as simple as that. Just tap your card on the machine. And your payment will be processed by the bank.

Do All Cards Support Contactless Payments?

No, not all cards support contactless payments. Only those cards which are capable of working with RFID can be used to make contactless payments.

The old debit and credit cards issued by the bank do not support this feature. But almost all the new cards support this feature.

We can say this has become a new normal or standards in the world of digital payments.

How to Check?

All the debit and credit cards that support contactless payments have a symbol on them. This symbol looks like that of the Wi-Fi and will be printed on the front side of the card.

If you have this symbol then your cards support contactless payments. In case you don’t find this symbol. Then this means your card does not support this feature.

What to Do if My Card Does Not Support Contactless Payments?

If your card does not support contactless payments. Then you can request your bank to issue you a new card that supports this technology.

Almost all Indian Banks issue cards that support this technology. But here you need to note that the bank will charge you an issuance fee for the new card.

The issuance fee depends upon the type of card you are getting from the bank. If the card is a normal one then the fee will be less. But in the case of a premium card, the charges may go up and also the annual maintenance charges.

How to Check the Issuance Charges or Fees?

Almost every bank has a schedule of charges page on its official website. You can use this page to know the charges. Just open the official website of your bank and go to the Schedule of charges page.

Let me explain to you how you find this page with an example.

For this, I will use the official website of IndusInd Bank. As you can see the “Schedule of Charges” link in the footer of the website. I will have to use this link to open the page.

After that, I will have to select the “Debit Card or Credit Cards”. In my case, I will select “Credit Cards”.

Now I have to look for the “Issuance Charges” this is also known as “Joining Fees” of the card of my choice.

Usually, the schedule of charges page will be in PDF format so you can even download it. But in case if you don’t want to look for the charge by yourself.

Then there is one more way to know the charges. Call the customer care of your bank and ask them about it. The customer care people will tell you the charges for the type of card you want.

How do Contactless Payments work?

Here we first need to understand the physical requirements for a contactless payment to happen. Not all the cards support this. In the same way, not all POS machines support.

So both the card being used and the POS machine should support this feature.

Contactless payment cards use RFID (radio frequency identification) to transmit data.

First of all the merchant who is receiving the payment has to prepare the machine to receive the payment. He or she should enter the amount to be paid by the customer.

Once the machine is ready to receive the payment. The customer has to tap the card on the upper part of the POS machine.

When this is done both the card and the machine will talk to each other. Because they are capable of doing it. The machine will read the card details.

And once the detail is read it will be sent to the payments processing network. It can be VISA, MasterCard, or Amex.

Then the payment network will run its series of checks,

- It will first check if the cardholder has flagged the card as stolen.

- Then it tries to understand if it is a fraudulent transaction. (using special algorithms)

- The balance on the card will be checked.

- If there is enough balance then the payment will be processed.

All this happens in a fraction of seconds. This is how contactless payment technology work.

Benefits of Contactless Payments

There are a lot of benefits of using contactless payment cards. Basically, there are 3 parties involved in the transaction. If we add the payment processing network. Then it will be 4 parties.

The banks have their own benefits, the merchants have their own set, and we the customers we have our own. But here let us focus only on the set of benefits to the customer.

1. Speed of Payments

The payments are done blazing fast when we use contactless payments technology. As soon as you touch or tap the card on the machine. The machine will start printing the receipt of the card.

It works that fast. So with this, we customers will be able to save a lot of time.

2. Effortless Payments

The payments that are done with the help of this feature are very effortless. Just tap your card and the payment will be processed.

There is no requirement of taking out your smartphone or count the cash. I would say contactless payments are more effortless than UPI payments.

Because in case of the UPI payments we generally need to scan the QR code. After scanning the code we have to enter the amount and then the UPI PIN Number.

But here we need not scan or enter any PIN. All we need to do is just tap the card. This is what makes contactless payments so effortless.

3. The Payments are Secure

When we are making use of contactless payments security is a concern. But still, if we use this tech in the right way with responsibility. Then the payments are secure.

How?

Here we are not entering any PIN number. This means there is no chance of our PIN being exposed or leaked to the merchant.

In some cases, the merchant might peak at the machine and make out the PIN that you are entering into the machine. But this can never happen when contactless payments are in use.

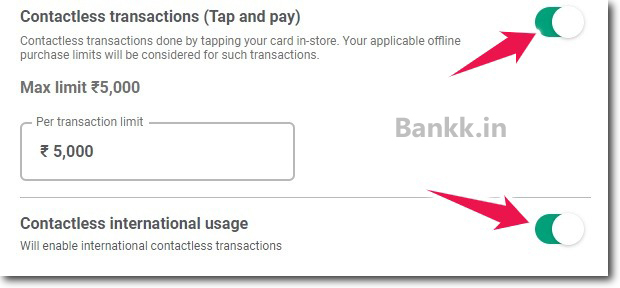

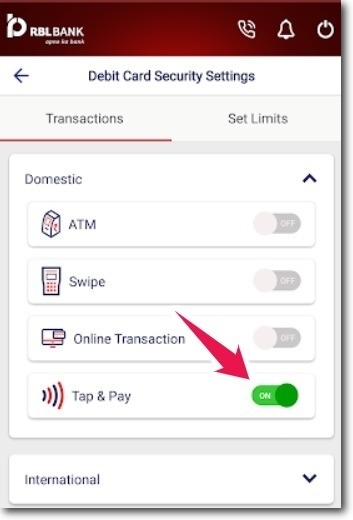

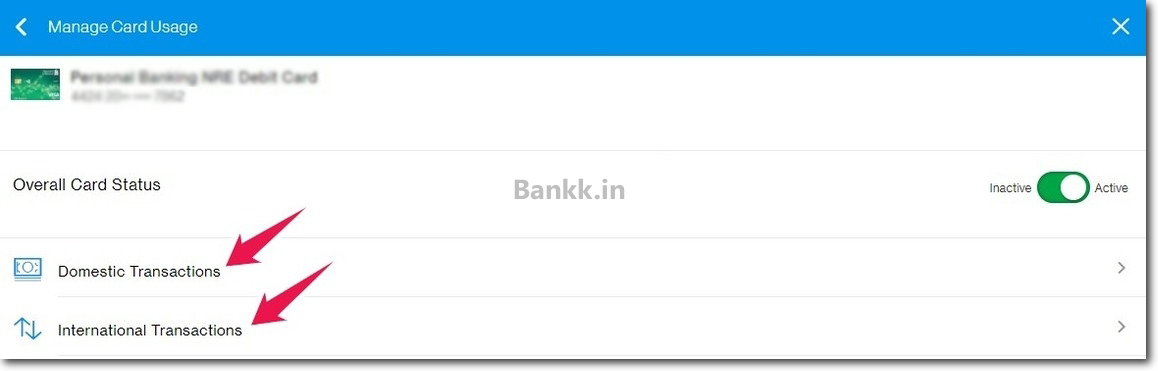

4. Flexibility to Enable and Disable

It is very easy to enable and disable contactless payments on your card. All you need is access to the internet banking portal or the mobile banking app of your bank.

If you feel you should turn off or disable this feature of your card. Then you can do it anytime, anywhere. And almost all the banks have enough powerful infrastructure to enable or disable instantly.

Types of Contactless Payments

There are multiple types of contactless payments that currently exist. I have explained those below.

1. Contactless Payments using Debit and Credit Cards

This is the major type of contactless payment that is used worldwide. To make this you will need a debit card or a credit card that supports this technology.

2. Mobile-based Contactless Payments

The second type is mobile-based contactless payments. Here no debit card or credit card is used. But instead of that a smartphone or a mobile device that supports NFC is used.

NFC is nearfield communication. This works just like the card. But there is a need for a payments app that supports contactless payments.

There are a number of apps that support this. Some of the examples are Google Pay, PayTM, etc. In most Android devices, there is a separate section that deals with this type of payment.

Where you can set up your default wireless payments app. And when you touch to hold the fingerprint sensor for 5 seconds or more. The app you have set will be opened.

3. Wearable Device-Based Contactless Payments

There is one more which is wearable device-based payments. Here there is no card or smartphone is used. But instead of that a wearable device is used.

This can be a smartwatch, fitness tracker, or wristband that supports this technology. These devices are preconfigured to work for payments. So you will just have to tap the device on the POS machine.

Are Contactless Payments Safe?

Yes, this type of payment is safe. But you have to take care that you don’t lose your card anywhere. If you have lost your card or it gets stolen. Then you should immediately block it.

If you don’t block it. Then anyone who gets your card can attempt to make the payments just like you do. And the money will be deducted from your account.

Other than this the technology which is used here to transmit the data between the card and the machine is pretty safe. It is very hard to decode customer information.

When we compare the same to that of the cards with a magnetic stripe. They give up on the customer information very easily to the card scanners. But in the case of contactless payments, the data transferred is encrypted.

I also recommend you disable contactless payment when you are not using it. This will make sure that no misuse can happen with your card. Whenever you need it get it activated again.

Will Bank Charge Me Extra?

No, the banks do not charge you anything extra particularly for the use of contactless payments. This is free but you also should know that normal card usage charges will be applied.

But other than that the banks in India have not told us about any charges. I also tried to look for the charges on the Schedule of charges page of major Indian websites. But I found nothing of that sort.

What if Contactless Payment Does not Work or Fails?

The probability of the contactless payment not working or failing is very little. But if this happens then still you can make the payment.

Swipe or insert your card into the POS machine. And enter your 4 digits PIN number. Contactless payment is an additional mode of payment to the normal Swipe and Dip mode.

So if this does not work use those, punch in your PIN and the payment will be done.

Can I Use my Contactless Payment Card Internationally?

Yes, you can use your card internationally for making contactless payments. If the merchant has the POS machine that supports this type of payment. And if you have this enabled for your card.

Then the payments network will pass your payment. You will not face any kind of issues while making the payment while you are out of India.

But you have to keep in mind that every country has its own limit on the monetary value of transactions. So keep track of this before tapping your card for the payment.

Can I Use Contactless Payments to Withdraw Money?

No, You can not use contactless payments technology to withdraw money from your bank account. As of now, there is no such mechanism that can help you to withdraw cash in any way.

How Much is Contactless Payments Limit in India?

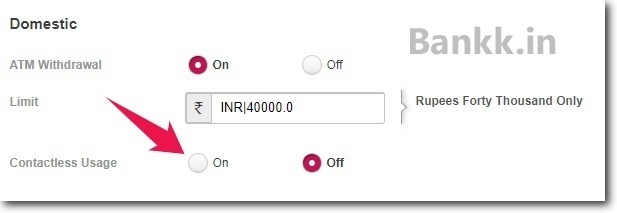

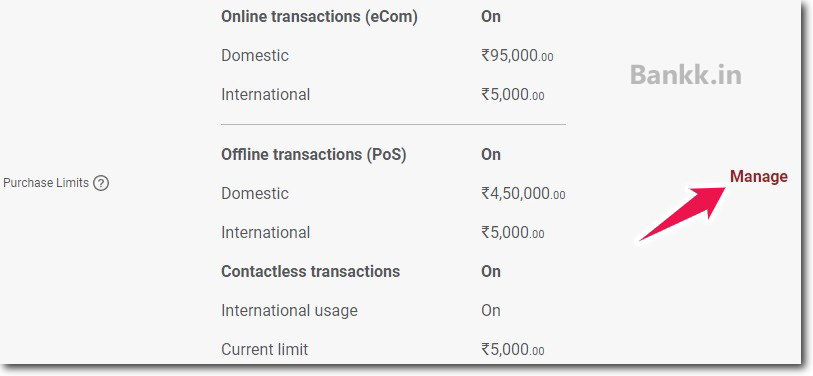

The maximum limit of contactless payment in India is Rs. 5,000. Earlier this was Rs. 2,000. But Reserve Bank of India allowed for payments up to Rs. 5,000 since 1 January 2021.

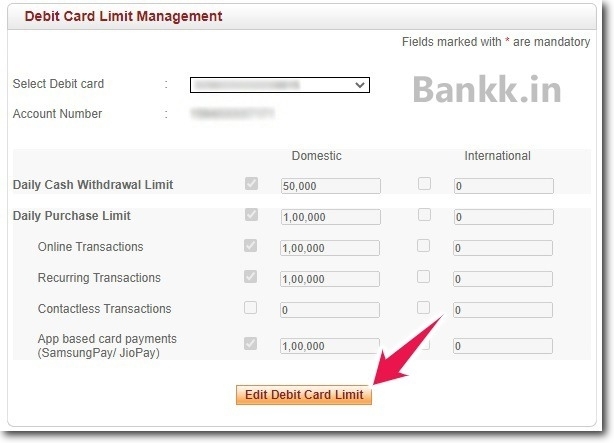

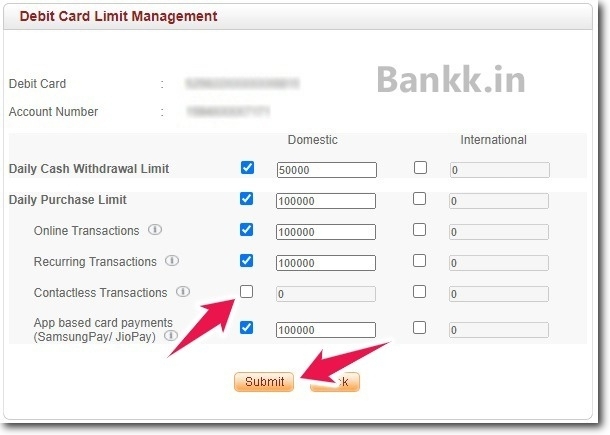

Can I Set My Own Limit on the Transactions?

Yes, you can set your own contactless payments limit on your card. This can be done with the help of the internet banking portal and the mobile banking app.

But you will have to make sure that your limit is equal to or less than Rs. 5,000.

Different Ways to Enable Contactless Payments on Debit and Credit Cards

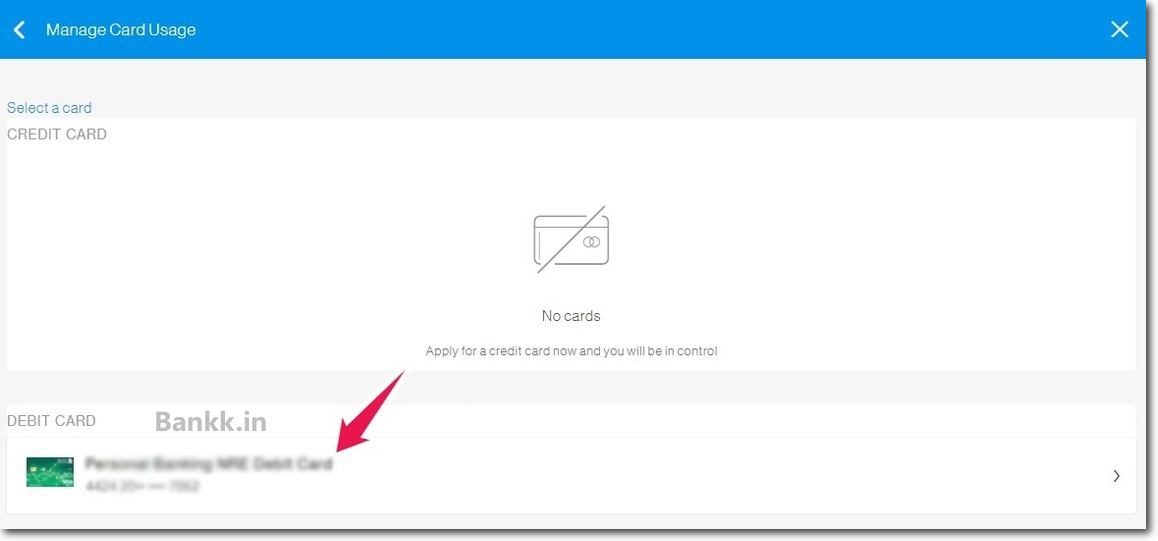

There are two ways to enable contactless payments on your debit cards and also credit cards. I have explained both the ways below. After this, I will give you bank-wise instructions.

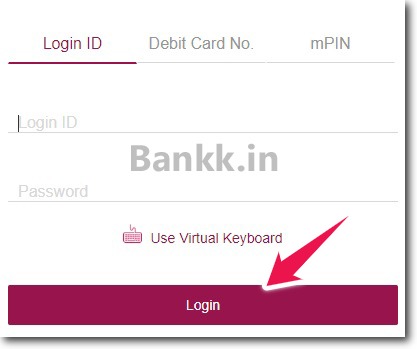

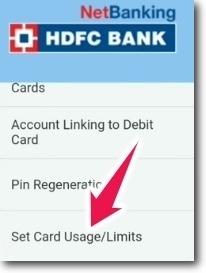

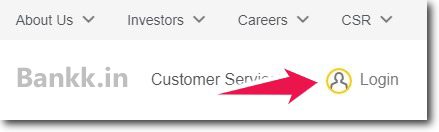

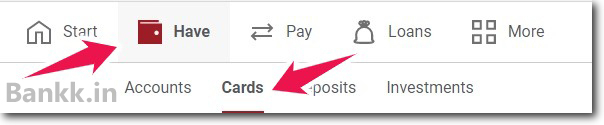

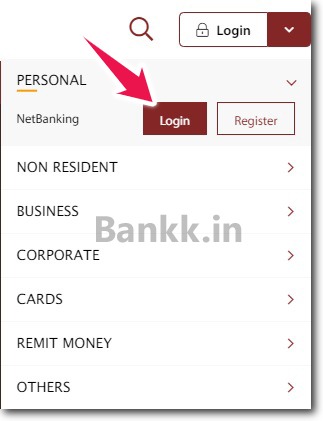

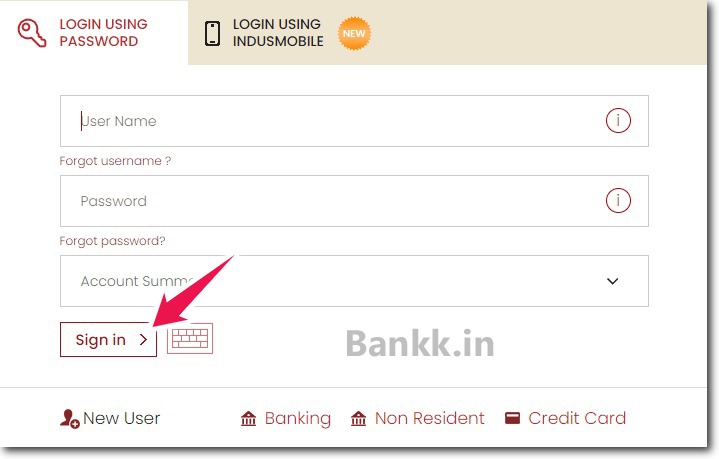

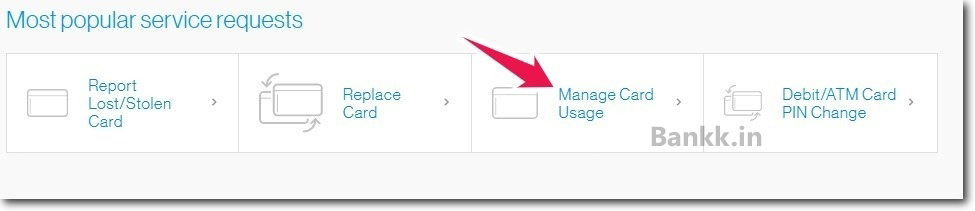

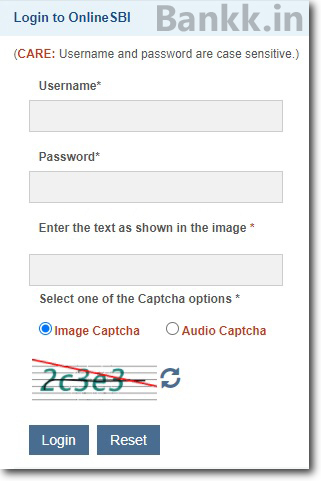

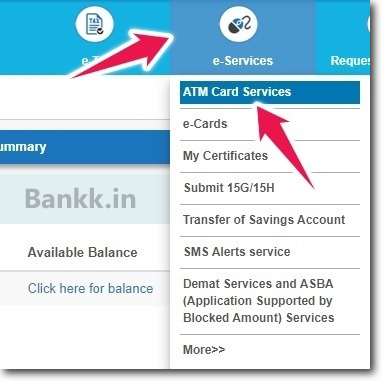

Using Internet Banking

The first online method is using internet banking. For this, you will need a desktop or a laptop computer with a stable internet connection.

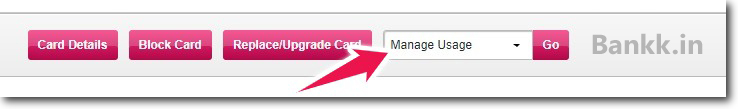

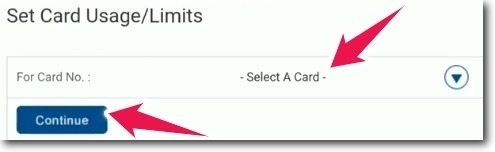

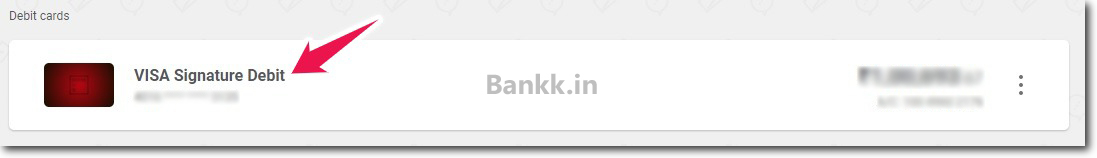

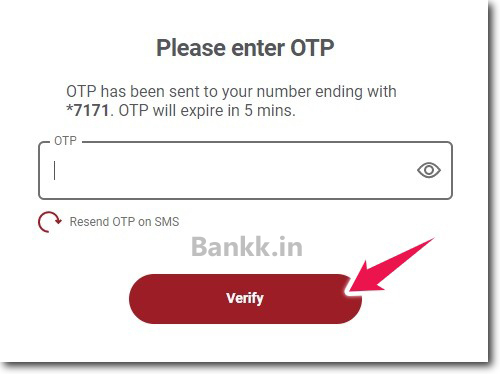

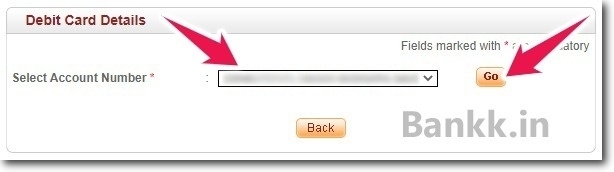

Open the official website of your Bank → Login to your Internet Banking Account → Open the Debit Cards Section → Select Your Debit Card → Click on Limit Management → Toggle the Button of Contactless Payments.

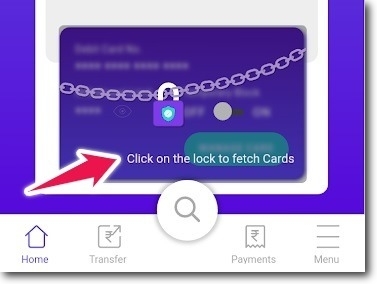

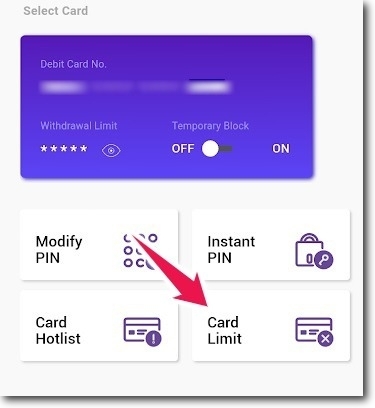

Using Mobile Banking App

For this, you will need the official mobile banking app of your bank. If you have it then that is fine. But in case if you don’t then get it installed.

Open the Official Mobile Banking App of your Bank → Login to your Account → Open Debit Cards Section → Select Your Debit Card → Open Limit Management → Toggle the Button of Contactless Payments.

Can I Enable or Disable Contactless Payments Offline?

No, as of now there is no direct offline process that you can follow to enable or disable contactless payments. But you can call the customer care of your bank. And request them to enable or disable it.

However, it is very rare that customer care can do it for you. But customer care will give you full instructions that you need to follow.

Choose Your Bank Here

The major Indian Banks that offer debit cards and credit cards with contactless payments technology are covered in this article.

You have to choose your bank below to find the instructions that you have to follow to enable contactless payments. Here the banks are arranged in alphabetical order.

My Bank’s Name is Not Mentioned Here

As I have already mentioned that the major banks are covered. I was not able to cover all the banks because of a lack of available information online.

Whichever bank has information about the contactless payments technology on its official website. And the other information I could get on the internet has been used as the resource of this article.

If you have received the card from your bank which has the contactless symbol on it. But if your bank’s name is not mentioned here.

Then there is no need to worry.

Just login into your internet banking account, go to the debit cards section, choose your debit card. And open the limit management section.

Limit management of the card is where you can enable and disable this feature. This remains the same with the mobile banking app as well.

Conclusion

This is everything you should know about contactless payments. And how you can enable and disable it on your card. Always keep in mind that you should never share your card’s details with anyone. For more help and information, you call the customer care of your bank.