A bank account is a financial account that is maintained by a bank or financial institution that is allowed to accept deposits from the public. The customer who holds the account can deposit, withdraw, and make transactions with the money in the account.

Each and every transaction that happens in the bank account be it a debit or credit is recorded by the bank. Although the banks are governed by the central bank of the country. But still, there are some policies that are created and maintained by the bank itself.

These are minor policies like the monthly average balance, debit card charges, SMS alert charges, etc. The banks have the freedom to create these minor policies but it does not mean they can do anything. There are some standards set and governed by the central bank of the country which should be followed by all the banks.

Types of Bank Accounts in India

There are different types of bank accounts that can be opened in India and offered by Indian Banks.

Savings Bank Account

The first and the most basic type of account that can be opened and maintained in India is the savings bank account. In this account, the customers can deposit their money, withdraw it.

And also make use of it for any transactions online and offline. The banks pay interest on the money which is deposited into the savings bank account. Usually, the interest is paid once a quarter which means 4 times a month.

Whenever someone goes to a bank and wishes to open a new account. This is the type of account that is first suggested by the employees.

Interest rates offered by every bank are different. I have made a table below in which I have mentioned the savings bank account interest rates that are offered by different Indian banks.

| Name of the Bank | Savings Bank Account Interest Rate (p.a) |

| AU Small Finance Bank | 3.5% to 7% 26 |

| Axis Bank | 3% to 3.5% 27 |

| Bank of Baroda | 2.75% to 3.20% 28 |

| Bank of India | 2.90% 29 |

| Bank of Maharashtra | 2.75% 30 |

| Canara Bank | 3.25% to 3.75% 31 |

| Catholic Syrian Bank | 2.10% to 3.90% 32 |

| Central Bank of India | 2.75 to 2.90% 33 |

| DCB Bank | 4% to 6.25% 34 |

| Dhanlaxmi Bank | 3% to 4% 35 |

| Equitas Small Finance Bank | 3.5% to 7% 36 |

| Federal Bank | 2.5% 37 |

| HDFC Bank | 3% to 3.5% 10 |

| HSBC Bank | 2.50% 38 |

| ICICI Bank | 3% to 3.50% 11 |

| IDBI Bank | 3% to 3.50% 12 |

| Indian Bank | 2.90% |

| Indian Overseas Bank | 3.05% 39 |

| IndusInd Bank | 4% to 6% 16 |

| Jammu and Kashmir Bank | 2.90% 40 |

| Karnataka Bank | 2.75% to 4.50% 41 |

| Kotak Mahindra Bank | 3.5% to 4% 42 |

| Punjab and Sind Bank | 3.10% 43 |

| Punjab National Bank | 3% o 3.50% 44 |

| RBL Bank | 4.75% to 6.50% 20 |

| South Indian Bank | 2.35% to 4.50% 45 |

| Standard Chartered Bank | 0.50% to 3.25% 46 |

| State Bank of India | 2.70% 47 |

| Tamilnad Mercantile Bank | 3% to 3.25% 48 |

| UCO Bank | 3.5% to 4% 49 |

| Union Bank of India | 3% 50 |

| Yes Bank | 4% to 5.5% 51 |

* Interest rates may change without notice

Current Account

The Current account is designed for businesses that do more transactions on the day to day basis. There is no limit to the number of transactions that can be done using a current bank account.

If you want to do any kind of business then this is the right type of account for you. The current account includes deposits, withdrawals, and other things similar to the savings bank account.

But the money which is there in this type of account does not earn any interest rate. This is dues to the high liquidity that can be seen in this type of accounts.

The documentation required to open a current account is a bit more and difficult when compared to that of a savings bank account.

The biggest advantage for the business having a current account is the overdraft facility. With the help of this feature, the business will have access to more money than they have in their account.

There is a prescribed limit for an overdraft for each account. And this type of account can be opened with almost all the commercial banks that are running their operations in India.

Fixed Deposit Account

A fixed deposit account is a saving instrument that is offered by the banks and also by the NBFCs. (non-financial financial companies)

Fixed deposit is also commonly known as FD. This type of account is opened with lumpsum money. And that money is locked for the said period of time.

For example, If you open a fixed deposit with any bank of Rs. 50,000 for 51 days. Then your money will be locked for 51 days, you are not allowed to withdraw with money.

But in case of any emergency if you break the FD then you will be charged a penalty by the bank or NBFC.

The interest rates which are offered by the banks are higher in the case of FDs when compared to that of the savings bank account.

By making an FD you can earn more interest than what you can earn by depositing the same amount of money in a savings bank account.

The interest rates offered by the NBFCs are a little more when compared to that of the commercial banks. The major advantage of the FD is your income is fixed and will not change with respect to any market fluctuations.

The interest rates offered by different banks are different. I have created a table below which tells you about the interest rates offered by every Indian bank.

| Name of the Bank | Fixed Deposit Interest Rate (p.a) |

| AU Small Finance Bank | 3.50% to 6.66% 52 |

| Axis Bank | 2.50% to 5.75% 59 |

| Bank of Baroda | 2.80% to 5.10% 28 |

| Bank of India | 3% to 5.30% 53 |

| Bank of Maharashtra | 2.75% to 4.90% 30 |

| Canara Bank | 2.95% to 6% 54 |

| Catholic Syrian Bank | 2.75% to 5.75% 32 |

| Central Bank of India | 2.75 to 5.10% 33 |

| DCB Bank | 4.25% to 6.75% 56 |

| Dhanlaxmi Bank | 3.50% to 5.60% 35 |

| Equitas Small Finance Bank | 3.60% to 6.65% 60 |

| Federal Bank | 2.50% to 5.50% 61 |

| HDFC Bank | 2.50% to 5.50% 10 |

| HSBC Bank | 2.25% to 4.50% 62 |

| ICICI Bank | 2.50% to 5.35% 11 |

| IDBI Bank | 2.90% to 5.60% 12 |

| Indian Overseas Bank | 3.40% to 5.25% 63 |

| IndusInd Bank | 3% to 6.50% 16 |

| Jammu and Kashmir Bank | 3% to 5.30% 40 |

| Karnataka Bank | 3.40% to 5.70% 58 |

| Kotak Mahindra Bank | 2.50% to 5.80% 42 |

| Punjab and Sind Bank | 3% to 5.30% 43 |

| Punjab National Bank | 3% to 3.50% 44 |

| RBL Bank | 3.25% to 6.50% 20 |

| South Indian Bank | 3.50% to 6.15% 45 |

| Standard Chartered Bank | 2.50% to 5.85% 46 |

| State Bank of India | 2.90% to 6.20% 22 |

| Tamilnad Mercantile Bank | 3.50% to 5.50% 48 |

| UCO Bank | 2.75% to 5.50% 57 |

| Union Bank of India | 3% to 5.60% 23 |

| Yes Bank | 3.50% to 7.50% 55 |

* Interest rates may change without notice

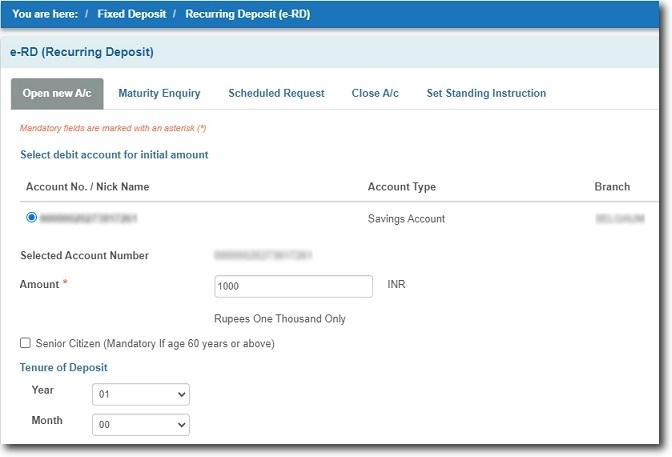

Recurring Deposit Account

A recurring deposit is also a saving instrument that is provided by the bank in India. Here the interest you will be earning on the deposit is similar to that of the fixed deposit but there is a major difference between these two.

In the case of the fixed deposit, you will have to lock the money in a lump sum. This means you will need a said amount of money ready with you.

But this is not the case with the recurring deposit. Here the person who has opened the deposit has the freedom to deposit the amount of his or her choice every month.

When you go to your home branch of the bank to open an RD or while opening using internet banking or mobile banking. You will be asked to enter the amount you want to save and the tenure of the deposit

Example: To explain to you how RD works I have instered a screenshot of my SBI internet banking screen when I try to open an RD.

The first thing is I am asked to select my bank account number form which the money should be deducted. And then I need to enter the amount and select the tenure of the deposit.

After that, I also have to select the maturity instruction for the Recurring Deposit. When done with all these things I will have to set the standing instructions for the deposit.

I will be having two options with me. The first one is I can set the instructions right now. And the second option is I choose to set the standing instructions later.

Some banks even offer higher interest rates for senior citizens. The interest rates offered by all the major banks on the Recurring Deposits are mentioned below.

| Name of the Bank | Recurring Deposit Interest Rate |

| AU Small Finance Bank | 5.75% to 8.03% 1 |

| Bank of Baroda | 3.70% to 5.25% 2 |

| Bank of India | 6.25% to 6.85% 3 |

| Bank of Maharashtra | 6% to 7.10% 4 |

| Canara Bank | 4.45% to 6% 5 |

| Central Bank of India | 6.20% to 7.50% 6 |

| DCB Bank | 4.25% to 7.25% 7 |

| Dhanlaxmi Bank | 6.50% to 6.90% 8 |

| Equitas Small Finance Bank | 6.50% to 7.15% 9 |

| HDFC Bank | 3.50% to 6% 10 |

| ICICI Bank | 3.50% to 6.30% 11 |

| IDBI Bank | 5.75% to 6.40% 13 |

| Indian Bank | 3.95% to 5.65% 14 |

| Indian Overseas Bank | 5.75% to 7.30% 15 |

| IndusInd Bank | 7.25% to 8.50% 16 |

| Karnataka Bank | 3.40% to 5.70% 17 |

| Kotak Mahindra Bank | 4.40% to 5.80% 18 |

| Punjab National Bank | 4.40% to 5.75% 19 |

| RBL Bank | 5.25% to 7.25% 20 |

| South Indian Bank | 5.40% to 6% 21 |

| State Bank of India | 5% to 6.20% 22 |

| Union Bank of India | 4.50% to 5.60% 24 |

| Yes Bank | 5.50% to 7.50% 25 |

* Interest rates may change without notice

Salary Account

A salary account is a bank account that is opened by the employer for his employee for the purpose of crediting the salary. This account can not be opened by an individual himself or herself.

Whereas a savings bank account can be opened by anyone by reaching out to the bank of the choice. But this is not the case with the Salary Account.

If you have a salary account then there is no need of maintaining any minimum balance or monthly average balance in your account.

The interest rate that you will be earning on your deposits is the same as that of the savings bank account. But in case your salary is not credited by your employee for more than 3 months.

Then the bank will automatically convert the account into a normal savings bank account. And if this happens you will have to maintain the said amount of average balance in the account.

Joint Account

A Joint account is a type of bank account that is opened by two or more individuals or entities. All the account holders will be having equal access to the funds in the account.

This type of account can be opened for the long term and also for the short term.

If you two business patterns want to get a joint for the period they will be running the business then that can be done. When they don’t want to continue their business and stop it.

At that time they can even close down the bank account. The banks also allow to remove or add account holders to the account.

Example: If a joint bank account is opened by Mr. ABC and Mr. XYZ for business purposes. And now they want to add Mr. PQR as an account holder.

They have the option to add MR. PQR, to get this done the account holders will have to submit their request to the bank. Every bank will be having a protocol that has to be followed in cases like this.

Conclusion

These are the major types of bank accounts that you can open in India. Other than these there is an account called a minor account which is opened in the name of a minor whose age is less than 18 years old. For those who are students, there is an account which is called a student account too.