Earlier if you want to get the money out of the bank account which is called withdrawal. You had to visit your home branch of the bank. And that too you have to go during the bank working hours. But this is not the case now. You can withdraw money out of your bank account at any point in time irrespective of the business days.

How?

With the help of the ATM card and the debit card that you receive from the bank.

In this article, we will understand what is an ATM Card, what is a debit card, the parts of the card, how you can use it, and plenty of related information.

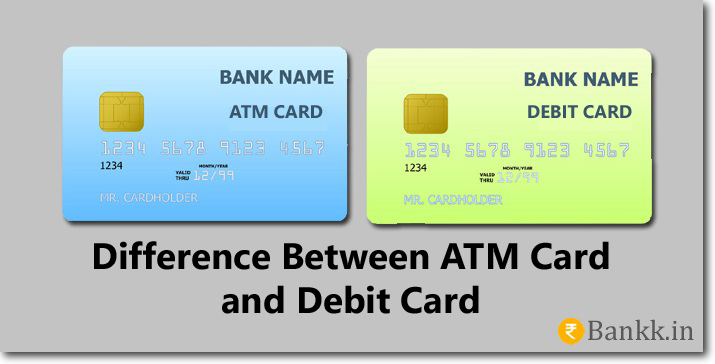

There are a lot of differences between ATM Card and Debit Card which we all need to understand. These two cards are not the same.

And when you open a new account you don’t receive an ATM Card but instead, the bank will give you a debit card. This sounds surprising, right?

Yes, it does because usually, people think these two cards are one and the same. But that is not the case at all. After you read this article entirely you will be able to differentiate them both.

What is an ATM Card?

An ATM card is a plastic card that is issued by the bank with whom you hold the account. This card has a magnetic strip on it on the backside.

The basic purpose of the ATM Card is to allow the account holder to withdraw money from the bank account without having to visit the branch of the bank. 1

This is the only purpose that is served by the card and you can not do anything more than this.

What is a Debit Card?

A debit card is just like ATM Card and even this is issued to the account holders by the bank. With the help of a debit card, you can withdraw money from your bank account.

You can also make payments at the Point of Sale, (POS) and online payments on the internet, order cheque book, check balance, get mini statement, etc.

This card is more than an ATM Card, it does the job of an ATM Card and has some additional utilities too.

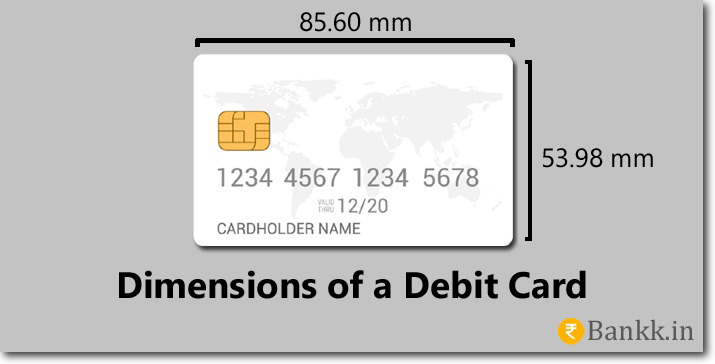

Dimensions of a Debit Card

A normal ATM card or a debit card issued by any bank will have the below-mentioned dimensions. 6

| Length | 85.60 mm or 3.370 Inch |

| Breadth | 53.98 mm or 2.125 Inch |

Difference between ATM Card and Debit Card

| ATM Card | Debit Card |

| The only purpose served by the card is to withdraw money using the ATM PIN number. | A debit card has multiple utilities you can withdraw money, make bill payments, and also shop online and offline. |

| You can not check your bank account balance using an ATM Card | The debit card can be used to check your bank account balance. |

| ATM Cards can not be used to get the mini statement from the ATM Machine. | You can get the mini statement using the debit card from any ATM Machine. |

| ATM Cards can not be used internationally. | Some debit cards issued by banks can be used internationally to withdraw money and make payments online and offline. |

| ATM Cards can not be used for EMI transactions. | You can buy things online on EMI transactions. Debit cards of major banks support EMI facilities. |

| Using ATM Card you can not order a cheque book through an ATM machine. | You can order a new cheque through an ATM machine using a debit card. |

| ATM Cards can not be used to make POS payments. | Using debit cards you can make payments at POS domestically and internationally. |

| ATM Cards can not be used to deposit cash into the account using the Cash Deposit Machines. | The debit cards can be used at the Cash Deposit Machines. |

| ATM Cards can not be used for booking train, bus, and air tickets. | The debit cards can be used for booking travel tickets. |

Other than these differences the different cards have logos of different payment services. It depends upon the system that is powering the transactions.

It can be Rupay, Mastercard, or VISA. The logo of the payment system will be embossed on the card. 2

Why Debit Cards were Introduced?

Things were working fine with the ATM Card, the account holders of the bank were allowed to withdraw money. But the ATM Cards served only this purpose.

The card was not usable for making any kind of online and POS payments. (offline) To eliminate this thing the debit cards were introduced by the bank. 1

Advantages of a Debit Card

Every Easy to Get a Debit Card: It is really very easy to get a debit card if you open a new bank account with any of the banks is in India. The bank will provide you a card by default. Unlike the credit card, you don’t need to show any income proof or credit score.

No Need to Carry Cash or Cheque: If you have a debit card with you then you need not carry cash or your cheque book. Whatever purchases you make you can pay for those using your debit card.

You can Withdraw Money 24×7: If you are in need of money then you can withdraw from your bank account 24×7 and 365 days a year. Even if it is midnight on a Sunday you can withdraw money from your account. All you have to do is find the nearest ATM machine.

Readily Accepted: In most places, the debit card is readily accepted. The merchants have proper infrastructure like the POS machine to accept the payment.

You can earn Rewards: These days almost every bank has a reward program for their customers. You will be earning reward points for every purchase you make using your card which can be redeemed later.

Disadvantages of a Debit Card

No Credit Grace Period: When you use a debit card the amount will be deducted from your bank account instantly. There is no grace credit period like credit cards.

There Should be Sufficient Balance: To use a debit card there should be a sufficient balance in your bank account. If you don’t have a balance then you just can not carry out the transactions. And in the case of some banks if you try to make a transaction that values more than the available balance you will be charged a penalty for the failed transactions.

Additional Charges: In the case of debit cards we will be having free usage transactions, once the free transactions are used completely. For every additional transaction done the bank will charge fees. This fee can go up to Rs. 20 per transaction.

When Does a Debit Card Expire?

A debit card issued by any bank expires between 2 to 5 years from the issue date. The expiry date will be printed on the front side of the card just below the card number. 7

For example, if the expiry date printed on a card is 08/21, then the card will expire on the last day of August 2021. (31/08/2021)

Why Do Debit Cards Expire?

The main reason why debit cards expire is for the purpose of security and fraud prevention. Even if the details of the card are exposed to someone in any way, then eventually the details will be of no use once the card is expired.

Other than this you also have to enter the expiry date of the card while doing any online purchases. This is one more detail that makes sure that the card is being used by the owner himself or herself and not others.

For example, even if the debit card number is exposed along with the CVV, (Card Verification Value) the card is unusable without entering the expiry date.

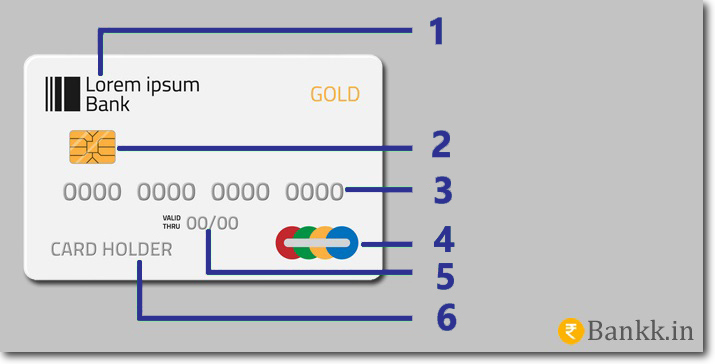

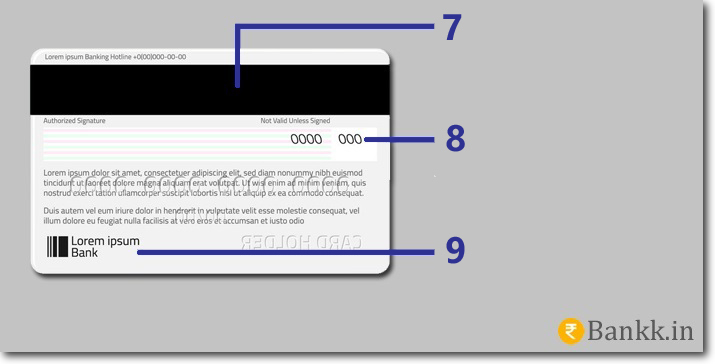

Parts of a Debit Card

The various parts on the front side and backside of a debit card are explained below. 3

- Logo of the Bank: The logo of the bank that has issued the debit card will be embossed here.

- EMV Chip: This is a chip that is used to store account information for better protection.

- Debit Card Number: This is the card number, usually this number will be of 16 digits. But there are some banks that have more than 16 digits.

- Logo of Payment System Provider: The company that manages the payments done by the debit card will be mentioned here. (RuPay, VISA, MasterCard, etc.)

- Valid Thru: This is the date after which the card becomes usable the month and year will be mentioned.

- Card Holder’s Name: The name of the person to whom the card is issued will be printed here.

- Magnetic Strip: This is a black strip used to store account information securely. Data in this strip can only be read by the card readers.

- CVV: This is a 3 digits code that is used as extra security while making payments online.

- Backside Logo of the Bank: Just like the front side the logo of the issuer bank will be embossed on the backside as well.

How to Use an ATM Card?

As we have already discussed that the ATM Card can only be used to withdraw money from your bank account. It is very unlikely that you will be having an ATM Card in 2021.

Your bank might have issued you a debit card. But still, if you want to learn how you can use an ATM Card. Then the steps are mentioned below.

- Go to any ATM machine irrespective of the bank that owns it.

- Insert your ATM card into the machine.

- Select the language in which you want to use the machine.

- Enter your 4 digits PIN number using the keypad of the ATM machine.

- Choose the “Withdrawal” option.

- Select the type of account you hold with your bank. (Savings Bank account or Current Account)

- Enter the amount you want to withdraw.

- Wait for the machine to dispense the cash.

- Collect the cash and take your ATM card from the machine.

How to Use a Debit Card?

A debit card can be used for a number of purposes. I will explain to you how you can use the debit card to withdraw cash, make online payments, and make POS payments.

Using a Debit Card to Withdraw Cash from ATM Machine

The process of withdrawing money from an ATM machine using a debit card is the same as using an ATM Card. All you have to do is,

- Insert your chip card into the ATM machine.

- Wait till the machine reads your card.

- Choose the language in which you want to use the machine.

- Enter your 4 digits PIN number into the machine.

- Select “Withdrawal” from the screen of the machine.

- Choose the type of account you hold with the bank.

- Enter the amount of money you want to withdraw.

- Wait till the machine processes your request.

- Collect the cash and your card from the machine.

Using a Debit Card to Make POS Payments

You can make payments for your purchases offline using a POS machine. To make a payment you first have to shop for something and then tell the merchant that you will make the payment using your debit card.

The merchant will take your debit card and insert it into the POS machine. After that, the merchant will enter the amount that you have to pay him or her for the purchase.

Verify the entered amount, and enter your 4 digits PIN number into the POS machine. The machine will then communicate with your bank.

If you have a sufficient balance in your bank account then the amount will be instantly debited from your account.

Using a Debit Card to Make Contactless Payments

The latest debit cards issued by the banks have an NFC component in them which enables contactless payments. If you have such a debit card then you can make seamless payments using a POS machine.

There is no need to enter your PIN number all you have to do is tap your card on the top part of the POS Machine. And the payment will be processed.

Currently, the maximum limit of contactless payments in India is Rs. 5,000. The limit was Rs. 2,000 earlier which has been now increased to Rs. 5,000 from January 1, 2021. 4

The process is very simple, tell the merchant that you want to make payment using your contactless payments card. The merchant will enter the amount in the POS machine.

Tap your card on the top part of the machine and the payment will be processed. There are 2 conditions the first one is there should be sufficient balance in the account. The second condition is the contactless payments should be enabled for your card.

How to Check if the Card Supports Contactless Payments?

It is true that not all cards support contactless payments. But it is really easy to check if your card supports contactless payments.

There will be a contactless payments symbol printed on your card if it supports contactless payments. I have shown the symbol in the image above, it looks like a Wi-Fi symbol.

How to Enable Contactless Payments for the Card?

If you try to make contactless payments when it is not enabled on your card. Then the payment will be rejected by your bank.

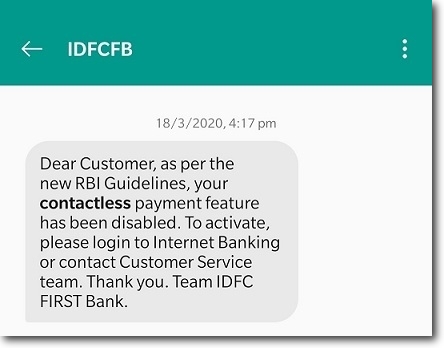

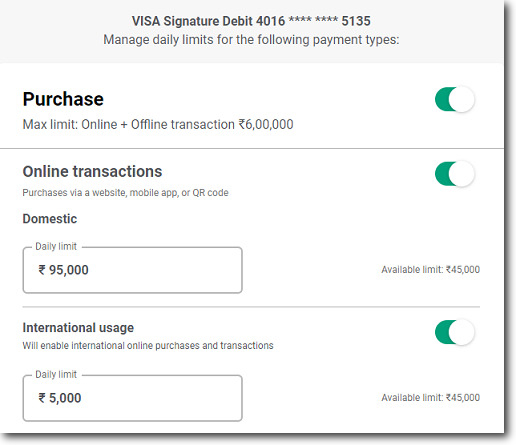

As per the RBI guidelines, contactless payments and the international usage of the card are disabled by default. 5 You can enable it by yourself.

Instantly you will receive an SMS from your bank explaining that the feature is not enabled. If you ever face this situation then let me tell you how you can enable contactless payments.

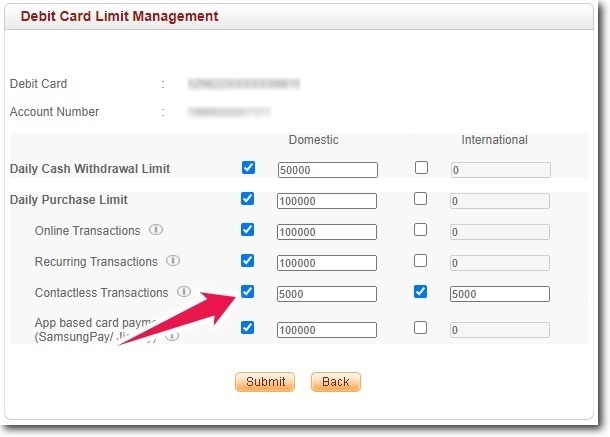

You can use internet banking to enable it. All you have to do is log in to your internet banking account. Go to the debit cards section.

Select the debit card and go to the limit management section. Enable the contactless payments and set your maximum limit.

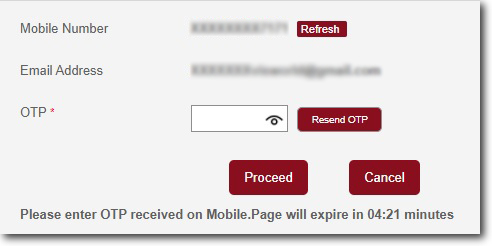

After entering the maximum limits that you want to have, you will receive an OTP from the bank on your registered mobile number. Enter the OTP and the contactless payments will be enabled instantly.

If you want you can disable it from the limit management section. I recommend you to keep it disabled unless you really want to use it.

Because if you ever lose your card somewhere the risk is more. In such cases to avoid the risk of losses, you should immediately block the card.

Using a Debit Card for Online Payments

When you purchase anything online you can make the payment using your debit card. I have explained the process below.

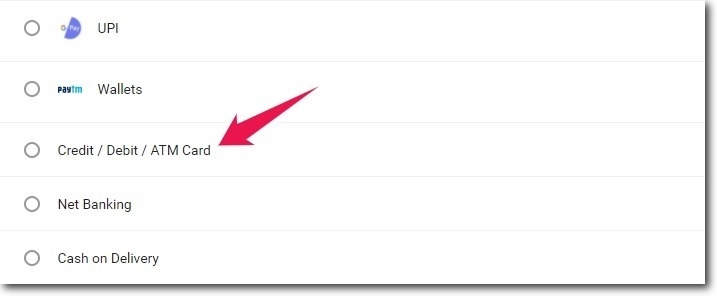

In this example, I am purchasing an item from Flipkart for which I want to pay using my debit card.

To pay using your debit card, add the item to your cart, enter the address, and proceed to make the payment.

Select Credit Card / Debit / ATM Card in the payment options.

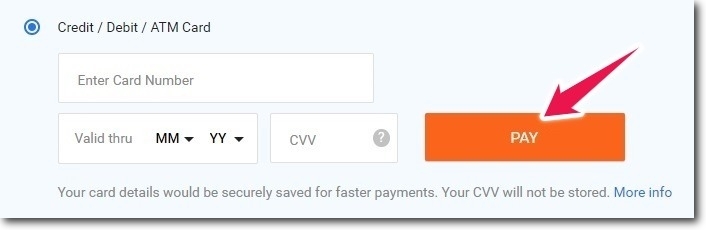

Enter your debit card number, enter the valid thru date, and the CVV that can be found on the backside of your card.

After entering all the details you have to click on the “Pay” button.

You will receive an OTP from your bank for authentication purposes, you have to enter that OTP to complete the payment on the next page and click on the “Proceed” button.

If you did not receive the OTP then you will also have an option to request the bank to resend it. This is how you can use your debit card to make payments from online purchases.

What is Debit Card Annual Fees?

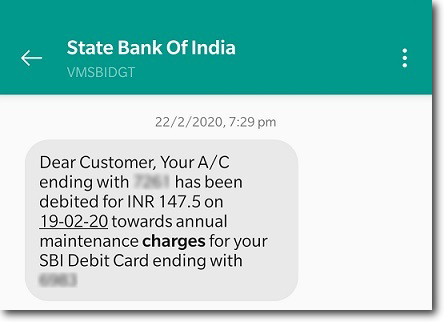

The bank will charge you every year for the usage of your debit card. This charge is deducted from your bank account once a year.

The customers have to pay this charge even if they have not used the debit card even once. There is no intervention of the customer while paying this charge.

Because the charge is automatically deducted from the balance available in the bank account.

How much is the Debit Card Annual Fee?

Every bank has different types of debit cards there are normal cards as well as premium cards that come with additional benefits.

This fee depends upon the type of debit card that you have received from the bank.

How can I Check my Annual Fee?

You can check fees charged by following 3 methods.

The first method is visiting the official website of your bank and look for the schedule of charges page. Every fee and charge related to the services offered by your bank will be mentioned in the schedule of the charges.

Once you have opened the schedule of charge find the debit card that you are using.

For example, VISA Platinum, the amount charged for this card will be mentioned there.

The second method is you can call the customer care of your bank. Choose the IVR options that will connect your call to speak with the support executive of the bank.

Once your call is connected ask the executive how much are you being charged for holding the debit card?

The support executive will put your call on hold for a moment. He or she will check the type of debit card you have been issued and will tell you the charges you are paying for the same.

Can I Avoid Paying the Annual Fee?

No, you can not avoid paying the annual debit card fees or charges because it is automatically deducted from your account balance.

And there will a clear communication from the bank while issuing the card about the annual charges. Normally people don’t know about this because people don’t focus much on the fees and charges that the bank account comes with.

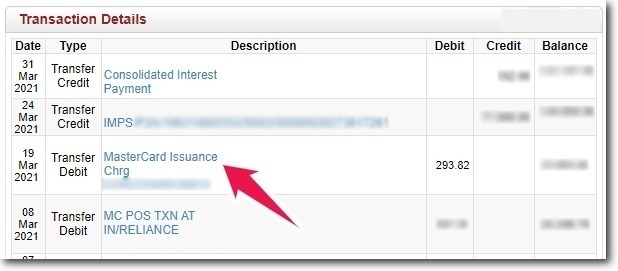

What is Debit Card Issuance Fee?

If you have requested the bank to issue a new debit card in case you need a new card. Then the bank will charge you for the issue of the new card. This charge is termed the issuance fee.

This charge depends upon the type of debit card you have requested from the bank.

Why was I Not Charged for the First time?

Normally when you open a new bank account the bank issues the card for free. There will be no extra charges that you have to pay for the first year other than the possible transaction charges.

This is why you were not charged for the first time or year when the bank has issued you a debit card.

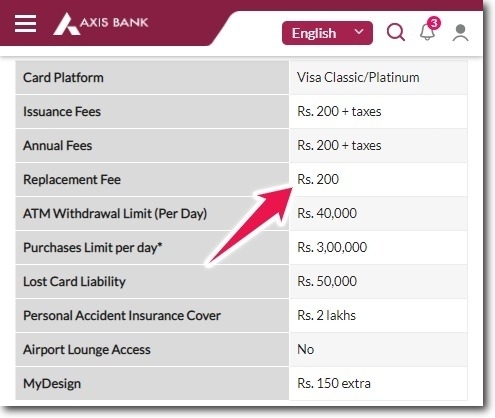

What is Debit Card Replacement Fee?

If you ever lose your debit card somewhere then you should block the card immediately. Once you block you can ask the bank to send you a replacement card.

Usually, the replacement card is not sent for free. The bank will charge you for the replacement card. Normally the replacement fee amounts same as the issuance fees.

Can I Avoid Paying the Replacement Fee?

No, you can not avoid paying the replacement fees. Because once your existing card is not usable anymore. And if you request a new debit card from the bank, the bank will first deduct the replacement fee from your bank account. And then the card will be delivered to your registered address.

What is Debit Card Withdrawal Limit?

This is the maximum amount of money that you can withdraw using your debit card from your bank account on any particular day.

For example, if you hold Axis Bank’s VISA Classic Debit card then the withdrawal limit is Rs. 40,000 per day. This means you will be able to withdraw less than or equal to Rs. 40,000 on any single day using that card and not more than that.

What is Debit Card Daily Purchase Limit?

This is the maximum value of the purchase you can do using your debit card. The purchase can be an online one or an offline one at a POS.

If your debit card has a daily purchase limit of Rs. 3,00,000.

Then you will be able to make a single purchase amounting to Rs. 3,00,000.

Or you can do multiple online and POS transactions that amount to a total of Rs. 3,00,000 per day.

If you try to make any transaction that amounts to more than the daily purchase limit then your transaction will be declined by the bank.

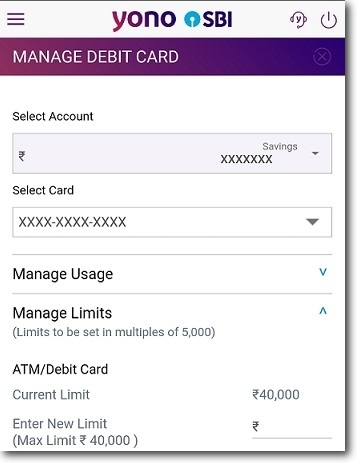

Can I Change Usage Limits of My Debit Card?

Yes, you can change the usage of limits for your debit card for daily purchases online, offline, and cash withdrawal.

But the limit you set should be less than or equal to the maximum limit of your card.

For example, if the maximum online purchase limit of your debit card is Rs. 3,00,000 per day. Then you can set a limit that is equal to or less than Rs. 3,00,000.

If you try to set the limit more than Rs. 3,00,000 then the bank’s system will not allow you to do it.

How to Change the Usage Limits?

You can make use of the internet banking portal of your bank or the official mobile banking application.

Login to your account and go to the debit card section. This works with both internet banking and mobile banking.

In the debit card section, all the cards issued to you will be displayed. Select the debit card whose limits you want to change.

Go to the “Limit Management Section”. Enter your new limits and click on the “Submit” button.

The bank will send you an OTP, enter the OTP correctly and your new limits will be set.

In the case of 90% of the Indian banks, the limit is changed instantly.

What is the Meaning of Debit Card Hotlisting?

Debit card hotlisting is nothing but blocking your debit card. If you have lost your debit card or misplaced it somewhere then you should hotlist it immediately.

You can hotlist the card by following multiple methods they are,

Using Internet Banking: Go to the official website of your bank, login to your internet banking account. Select the lost debit card and click on the “Block” button.

By Sending SMS: There are specific keywords that you have to use to block the card. Type the message in the format prescribed by your bank and send the SMS from your registered mobile number. You can find the SMS keywords on the official website of your bank.

Using Mobile Banking App: Open the app, select the debit card that you have lost and tap on the block button.

By Calling Customer Care: Call the customer care of your bank, use the IVR option to block or hotlist your lost card.

Please Note:

- This website is not an official part of any bank. Please don’t enter any of your details here.

- You should not share your debit card number, PIN number, CVV, and OTP with anyone.

- The bank officials will never contact you asking for such details.

- You should never enter your card details on any third-party websites unless you trust them.